As an essential component of a trader’s toolkit, the average true range (ATR) trailing stop is an effective tool that not only manages trade but also defines the trend. By allowing traders to establish an exit point defining when it’s time to sell, the ATR trailing stop is a tool that removes the emotional factor from decision making, making it a more systematic means of protecting capital and locking in profits.

Understanding the Basics of the ATR Trailing Stop

The ATR trailing stop is based on the Average True Range (ATR), a volatility indicator created by J. Welles Wilder, and its purpose is to measure market volatility by decomposing the entire range of an asset price for a certain period. It is an exponential moving average (EMA) that adjusts according to market volatility. The EMA reduces the lag by applying more weight to recent prices relative to older prices. The shorter the period, the more weight applied to the most recent price.

Application of the ATR Trailing Stop

In a basic application of the ATR trailing stop, traders would set their trailing stop at a certain multiplier of the ATR indicator. For example, if the ATR is 20 pennies, a trader might set their trailing stop order 30 pennies below the price. This 1.5 times the ATR effectively allows the price to fluctuate while protecting against a significant negative move.

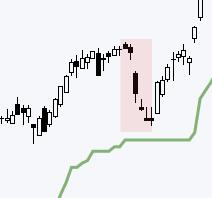

The ATR trailing stop is used for both entry and exit. When the price crosses the ATR trailing stop line, a trader could enter to buy or sell. Exiting the trade occurs if the price crosses the ATR trailing stop line in the opposite direction.

Enhancing Trend Identification with the ATR Trailing Stop

The ATR trailing stop is known for more than just managing trades. It is a handy tool for defining the trend, thus increasing the potential for trading success.

The ATR trailing stop can indicate a change in trend when the market price crosses the line. For example, in an uptrend, the ATR trailing stop line is below the price, and for a downtrend, it is above the price. Thus, if the price crosses the ATR trailing stop line from below, it signals a trend change from up to down, and vice versa.

Final Thoughts on Using the ATR Trailing Stop

In conclusion, the ATR trailing stop is a beneficial trading tool. Its unique ability to manage trade by setting an exit point and defining a trend makes it an effective part of a trader’s toolkit. By utilizing the ATR trailing stop, traders can sift through the market noise, identify when the trend is shifting, manage risks, and secure profits more efficiently. Like anything else in trading, while it is not foolproof, its effectiveness comes with understanding and experience. It’s essential that traders validate the use of this tool with other indicators and use it as part of a comprehensive and well-thought-out trading plan.

As with any other strategy, the ATR trailing stop should be used as part of a larger trading strategy, taking into account other technical analysis tools, market conditions, and trader risk tolerance. Effective use of the ATR trailing stop, aligned with a well-established trading plan, could safeguard against unnecessary losses and help traders achieve their financial goals.