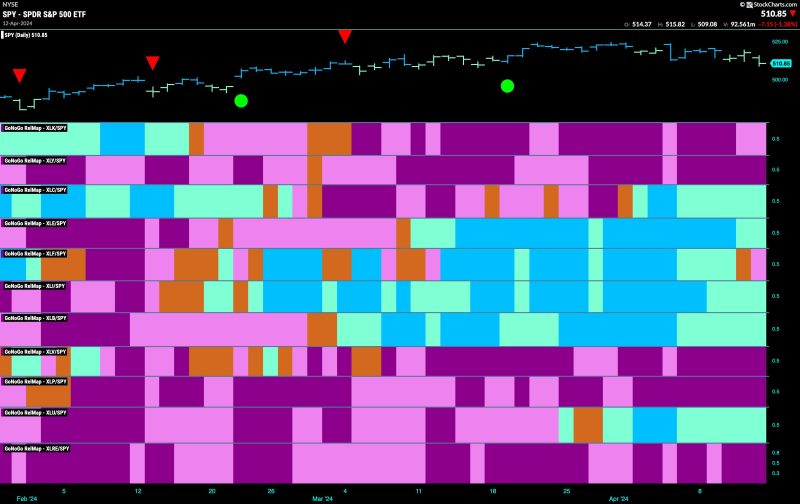

Heading into the midway mark of April 2024, equity markets are showing signs of weakness, struggling to maintain their initial “Go” trend. Even with the industrials moving back to the forefront and attempting to lead the market, there is a growing worry creeping into the minds of investors.

Dynamic shifts in world politics, coupled with economic uncertainties, have caused several major global equity markets to shift from their upbeat tempo at the beginning of the year. Burdened by these geopolitical tensions and macroeconomic pressures, across the horizon, financial markets are trying to stabilize while attempting to balance the scales of supply, demand, and investor sentiment.

Market analysts all around the world have suggested that the struggle to maintain the “Go” trend is mostly due to the unpredictability of the current geopolitical climate. In addition, doubts concerning instabilities related to the economic effects of major international events have added to the financial market’s growing uncertainty.

Amidst this, the industrial sector is emerging as a rampant contestant. It is believed that the sector’s familiar surroundings, the well-encased supply chain, and its ability to withstand economic turmoil makes it a potential rescuer for the unstable equity market. The sector is trying to guide the markets toward a sturdier region of the economic zone.

This sector, which comprises of a wide range of corporations focused on manufacturing and distributing goods, is witnessing significant growth in certain regions. It’s attempting to establish itself as the leader once more in an ever-evolving and dynamic market scenario.

The resilience shown by the industrial sector does offer some hope. The spiraling energy prices, combined with the advent of cost-effective technologies, have allowed the industry to flourish. Innovative solutions are surfacing to tackle major issues like high energy cost and dependency on non-renewable sources of energy. The sector is attempting to transform these threats into opportunities and is thus paving the way for a potentially optimistic future.

Moreover, investment trends point towards increased interest in industrials. As investors search for avenues that can continue to generate profits, industrial assets can offer measurable stability. Equities in this sector are prepared to benefit from the global emphasis on infrastructure development and manufacturing, inclined with the economic recovery strategies being actively executed worldwide.

Despite the optimism, the battle is far from over. The question remains whether the industrial sector can carry the whole burden of leading the equity markets towards more stable grounds. It’s a significant task, and with it comes increased responsibility. It is essential to remember that although industrials are to an extent sheltered from geopolitical risks compared to other sectors, they are not entirely immune to larger macroeconomic forces.

So as we delve deeper into April 2024, it remains to be seen whether equity markets can regain their initial Go trend or whether this struggle is a sign of more fluctuations to come in the future. The industrials, resilient as they may be, can provide guidance, but fixing the state of global equity markets might take more than what one sector can deliver.