In the realm of monetary management, the Rule-Based approach is an established strategy. It employs a set of pre-determined, objective rules to steer a firm or individual’s financial decisions. While we’ve already explored some fundamental rules in earlier sections, this part will delve further into how the rule-based framework makes use of relative strength and other measures.

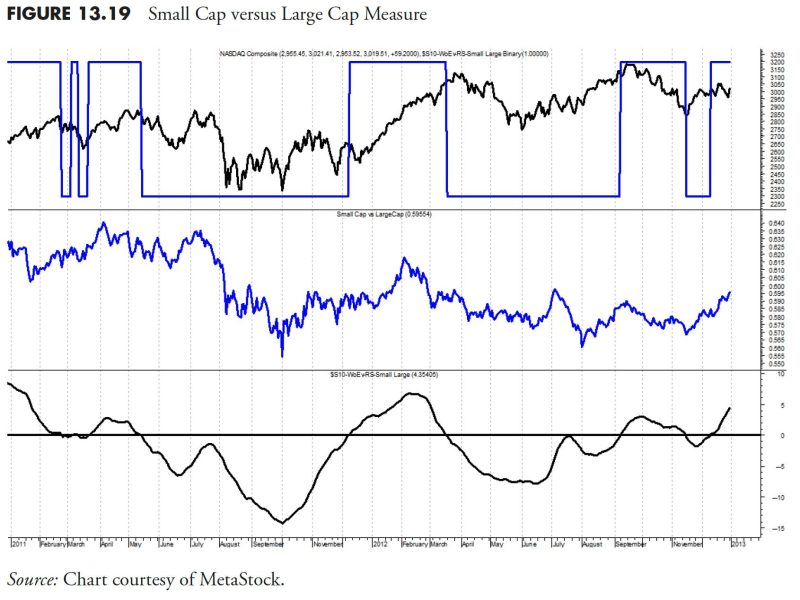

Relative strength, an integral aspect of rule-based money management, is a tool used to gauge an investment’s price performance in comparison to other investments or a benchmark. For instance, if a mutual fund proves to retain more of its value in a declining market than most others do, it will have higher relative strength.

The primary purpose of relative strength comparisons is to identify financial instruments that are performing well, indicating their potential to yield future gains. In a rule-based money management system, one rule could direct you to invest more in assets with high relative strength, as they have demonstrated superior performance and offer a higher probability of sustained returns.

Relative strength isn’t the only measure used in rule-based money systems. Other rules might revolve around indicators such as the rate of return, volatility, and portfolio concentration.

The Rate of Return is a percentage-based measure of the profit or loss made on an investment over a specific period. For instance, one rule might require pulling out of an investment if its rate of return falls below a certain percentage.

Volatility is another critical measure. Investments can surge and stumble unexpectedly, and understanding the magnitude of these fluctuations can assist in decision-making. For instance, you might have a rule to sell a portion of your investment if its volatility exceeds a specified range to manage your risk.

Portfolio concentration pertains to diversification. If too large a portion of your overall portfolio is entangled in a single investment or sector, it leaves you vulnerable to significant losses if that investment or sector performs poorly. Rule-based systems may include guidelines to limit investments in any single class of assets to avoid unnecessary risk.

Furthermore, in rule-based money management, the parameters for these measures are often determined using either conventional wisdom or historical performance analysis. Traditional wisdom might suggest a rule of thumb like never have more than 5% of your portfolio in a single investment, while historical performance analysis might indicate that an investment typically rebounds after a particular percentage drop, suggesting a buying opportunity.

In rule-based money management, these guidelines improve decision-making by eliminating emotion from the equation, promoting rational choices based on solid, quantitative data. Utilizing relative strength and other measures in a rule-based approach helps to maintain a disciplined and methodical investment strategy. This replaces hasty judgments made out of fear or greed with systematic actions that are likely to deliver more consistent results.

However, no matter how accurate a rule may be, they should not be applied blindly. Contextual understanding of market conditions and a thoughtful, holistic approach are essential complements to these rule-based measurements. Moreover, as with any financial strategy, a rule-based system won’t eliminate risk altogether – but it will provide a framework for managing that risk proactively, which is the key objective of any good money management system.