Security Ranking Measures in Rules-Based Money Management

As Part 4 of our discussion around rules-based money management, we delve into a key aspect known as security ranking measures. This approach can sometimes be thought as an auxiliary to the basic structure of managing resources but is, in fact, a critical component of creating efficiency and securing profits.

Security ranking measures often influence a portfolio’s construction and its dynamic adjustments. This component within the rules-based money management system becomes an efficient way to perform a comparative analysis of securities based on their potential to generate profits, their associated risks, and their general financial health.

Understanding Security Ranking

Security ranking starts with the idea of sorting out a diverse basket of securities based on specific predefined parameters. These parameters typically include factors such as momentum, valuation, volatility, financial health scores, and investment risk scores among others. This systematic ranking method provides an objective way to sift through the wide array of securities, making it easier for an investor to decide on which securities to hold, avoid, or adjust.

Benefits of Security Ranking

One principal advantage of security ranking measures is the extraction of emotion from investment decisions. It helps to create an objective system which determines the desirable securities in an investor’s portfolio based on their score. Hence, the rules presented through this ranking provide a reliable, bias-free indication of where to put one’s money.

Secondly, security ranking measures help to ensure diversification. Using a variety of factors to assess and categorize securities ensures that an investor’s portfolio is not overly dependent on one industry, company, or type of security. This approach helps minimize risk by spreading investments across different assets that show potential for growth or stability.

Methods Used in Security Ranking

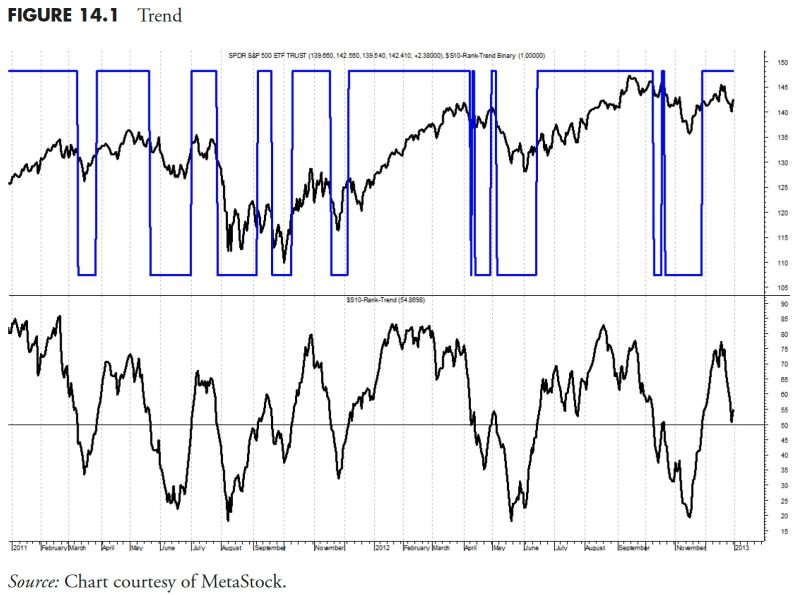

1. Momentum Ranking: This technique involves ranking securities based on their past performance. The belief underlying this approach is that securities that performed well in the past will likely continue to do well. Momentum ranking can be an effective way of identifying securities that are trending upwards or downwards to make informed investment decisions.

2. Valuation Ranking: This ranking measures the attractiveness of a security’s current price. It compares the security’s intrinsic value to its market price. Securities that are undervalued are ranked higher as they offer more potential for profit.

3. Risk Ranking: This approach takes into account the risk associated with a particular security. Securities with lower potential risks are ranked higher because they decrease the possibility of loss.

4. Financial Health Ranking: This method involves assessing a company’s financial health, including factors such as cash flow, debt levels, and earnings growth. Companies that are financially stable and have promising financial trends are ranked higher.

In sum, security ranking measures are an essential component of rules-based money management. They offer a structured way to manage investments, minimizing bias and emotion while maximizing diversification. Through effective security ranking strategies, investors can optimize their portfolio construction, making sound decisions based on objective analysis.