The landscape of the National Stock Exchange’s benchmark index NIFTY reveals a trajectory marked by volatility. Over the coming week, it is postulated that NIFTY will journey through a tumultuous market terrain, faithfully reflecting the emergent trends in the global financial marketplace. As investors prepare their strategies for the coming week, it is recommended to reduce leveraged exposures as a part of a prudent risk management strategy.

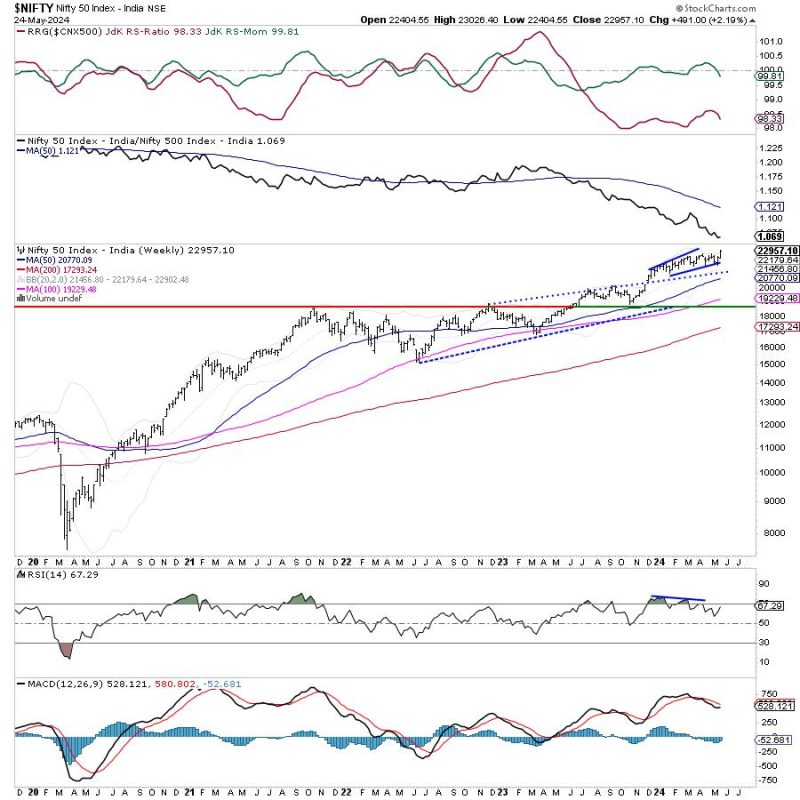

Diving into the technical fundamentals, it is clear that the NIFTY’s movements will be defined within a robust range, where volatility can be both a risk and an opportunity. The volatile spectrum within which NIFTY is projected to operate will most likely emanate from global cues, domestic fiscal factors, and corporate earning reports. In this unpredictable environment, NIFTY’s movements can offer an accurate pulse of the market’s overall health.

It is predicted that the global market trends will inject substantial momentum into the movement of NIFTY. The drift will be driven by major events on the international front such as monetary policy decisions, trade dynamics, and geopolitical developments. These elements have the power to sway investor sentiment, thereby impacting the buying and selling pressure on the NIFTY.

Considering domestic fiscal factors, it is clear that fluctuations in the lending rates, fiscal policy changes, and RBI’s monetary movements have a consequent bearing on NIFTY’s direction. Policies focused on boosting economic growth and stabilizing inflation could steer NIFTY’s movements towards an upward trajectory, while tightening measures could pull the market down.

Adding to the economic and political factors are the corporate earning reports. It is a well-known fact that the NIFTY reflects sentiments towards corporate performance. As businesses across industries release their quarterly results, the aggregate reaction from investors can cause monumental shifts in NIFTY.

While the ride promises to fluctuate, the recommended strategy during these volatile periods would be to curtail leveraged exposures. Leveraged exposure implies borrowing to invest more than the initially invested capital. While it provides an opportunity to earn more profits, it also poses the risk of increasing losses. When the market is inherently volatile, it is advisable to minimize these leveraged exposures to safeguard against possible downturns.

Navigating through high volatility also demands different trading strategies. Traders could adopt methods like hedging to protect their portfolios from volatility. Furthermore, focusing on long-term investment strategies and diversifying the portfolio across sectors can assist in mitigating risk.

Finally, it is pertinent to recognize that unpredictability is a hallmark of market dynamics. Navigating through the projected volatile range of NIFTY is as much about staying informed, as it is about making mindful investment decisions. By curtailing leveraged exposures and adopting a well-crafted risk management strategy, investors can rise above the tumult and steer clear of potentially testing waters.

Summarily, in the week ahead, investors should brace for a ride where the tunes of volatility and uncertainty are played out on the NIFTY charts. However, through cautious strategies and a keen eye for recognizing early signs of market swings, one can make the most out of this period of volatility.