The saga of a former FTX executive who conspired against his boss, Sam Bankman-Fried, came to a conclusive end recently when he was sentenced to seven and a half years in prison. This tale of treachery, subterfuge and high finance has sent shockwaves throughout the world of cryptocurrency trading.

FTX is one of the fastest-growing firms in the world of cryptocurrency, and at its helm is its founder, Sam Bankman-Fried, a young billionaire who catapulted to fame with his savvy strategies and disciplined approach. He built the FTX platform under a vision of transparency, integrity, and equity – values that were seriously challenged with the deceit carried out by one of his very own executives.

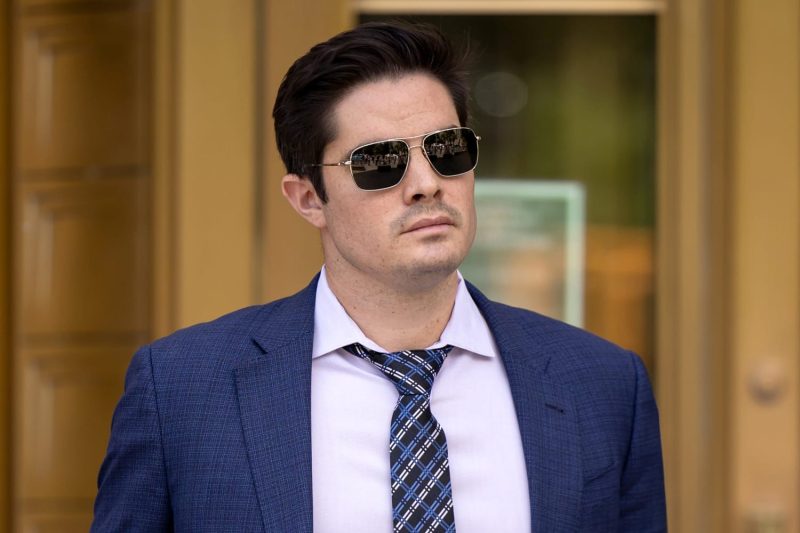

The disgruntled executive, whose identity has not been disclosed due to pending legalities, was first suspected of unethical conduct when discrepancies began surfacing in the company’s internal audits. Investigations revealed an intricate web of plans to bring Bankman-Fried’s increasingly influential virtual empire to a crashing halt. The executive was found guilty of several white-collar crimes including conspiracy, fraud, and embezzlement.

The executive’s primary charge was of conspiracy to commit fraud against FTX. He had designed and implemented a series of intricate subterfuges and deceptive practices intended to undermine the infrastructure of FTX for his personal gain. In doing this, he not only breached the company’s trust but also contravened the ethical parameters of his professional mandate.

One sore point in this tale of deceit has been the executive’s relentless assault on FTX’s operational strength. He schemed to carry out a major cryptocurrency heist from the firm, which would’ve seriously jeopardized its credibility and financial stability. Fortunately, this theft was unearthed before its execution.

Further investigations revealed that the executive had been embezzling funds subtly over a considerable period, funnelling cryptocurrency to personal and anonymous wallets. His arrest brought an end to these illicit activities, but it also raised questions about the security protocols at FTX.

The executive’s sentencing, upheld by a district judge, sends a strong message about law enforcement and the judicial system cracking down on digital crimes. They are no less egregious than their traditional counterparts, and are as subject to the rule of law. The landmark ruling also highlighted the vulnerabilities within the cryptocurrency market, underlining the need for enhanced security measures and surveillance.

This notorious case also posed significant implications for FTX’s reputation. Although it survived the storm, it has led the firm to ramp up their internal control measures and adopt stricter hiring practices to prevent such incidents in the future.

The incident is a cautionary tale for companies in the crypto sphere. Despite the sentencing of the executive, a sense of vigilance has gripped the industry. It serves as a stark reminder that, while technologies advance, human nature remains susceptible to temptation and ill-will. Firms must recognize and combat this by deploying sophisticated checks and balances to curb the possibilities of internal fraud.

FTX, battered but not broken, learns a bitter lesson about trust and deceit. Despite the ordeal, the firm remains a key player in cryptocurrency trading, guided by the resilient leadership of Sam Bankman-Fried, who continues his pursuit to make a mark in the world of finance amidst the ripples caused by this incident.