The Hindenburg Omen, named after the infamous German airship that met a fiery end, is a technical market pattern that has been projected to predict not just any downturn, but a severe stock market crash. So, what happens when this indicator buzzes an initial sell signal? Why is it such a significant event in the world of trading and investing? Here’s a detailed probe into this ominous concept.

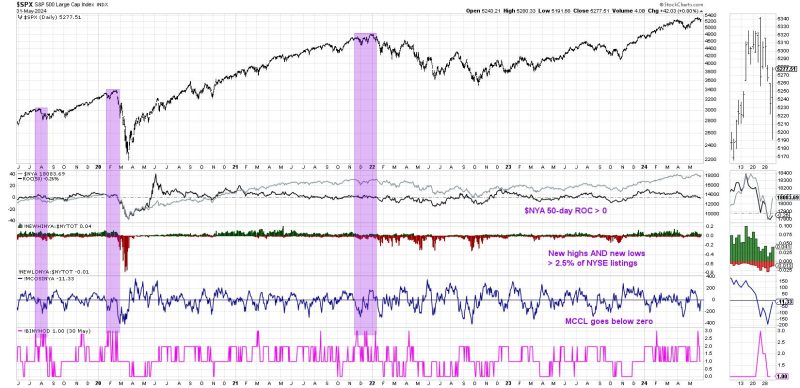

First and foremost, the Hindenburg Omen derives its name from its theoretic ability to predict impending market crashes, in perfect symbiosis with the sudden disaster that befell the German airship in 1937. Interestingly, this complex technical indicator is not merely based on one factor. Instead, it entails multiple triggers to corroborate its accuracy. The two primary prerequisites are: an increasing number of new daily highs and lows in the New York Stock Exchange and a negative or falling McClellan Oscillator, which measures the market’s momentum. If these two conditions coincide with a rising 50-day moving average of NYSE, the Hindenburg Omen flashes a sell signal.

Many investors and traders are keen to monitor these signals due to their historical track record of predicting significant market downturns. However, it is crucial to mention that while an activated Hindenburg Omen is often followed by a market decline, not all declines are preceded by an Omen. Moreover, false signals are not entirely uncommon, making this technical indicator an imperfect, albeit thought-provoking, tool for risk management strategies.

Another intriguing facet of the Hindenburg Omen is its statistical rarity. The simultaneous occurrence of its multiple conditions is not a common event, appearing only a handful of times over the past decade. Such infrequency escalates its significance amongst market watchers since every activation invariably brings forewarning of potential volatility ahead. Although the sell signal doesn’t always connote a guaranteed disaster, it certainly warrants paying keen attention to further market movement.

On the practical implications side, an initial sell signal from the Hindenburg Omen should not instantly prompt investors to liquidate their assets. Instead, a more prudent approach would involve considering the warning alongside other market trends, economic indicators, and investment goals. Reacting impulsively to a single signal may lead to rash decisions, potentially glancing past profitable trades or succumbing to panic selling.

It is also worth noting that while the Omen predicts drastic market crashes, the severity of these crashes can vary significantly. The indicator doesn’t measure how drastic a given crash will be, making it essential for investors to steer their focus towards managing their portfolios efficiently rather than predicting the precise timing or scale of potential crashes.

In the final analysis, the Hindenburg Omen, with its flashes of initial sell signals, acts as a prophet of potential market doom. Its infrequent appearance and multifaceted conditions make it a noteworthy event in the world of trading and investing. Nevertheless, as with all indicators, it is not foolproof nor should it be the sole determinant in making investment decisions. It is best utilized as one piece of a comprehensive investment strategy, supplementing other technical indicators and fundamental analysis methodologies to identify potential trading and investing opportunities.