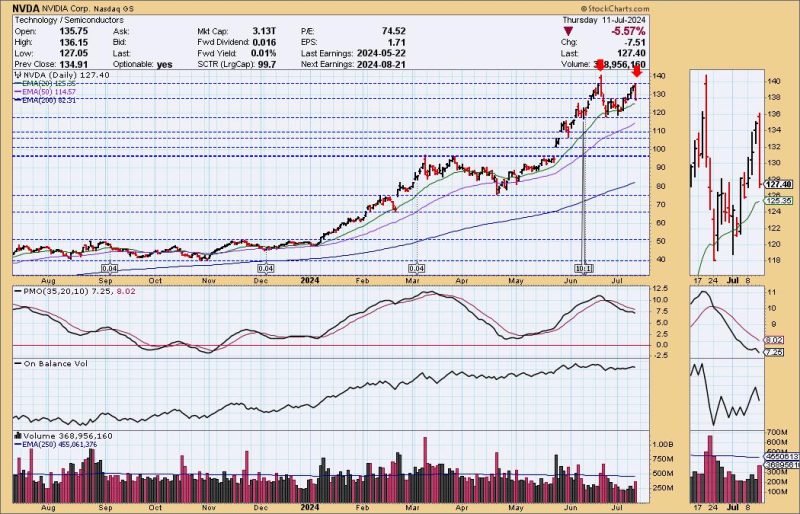

Firstly, let’s take a close look at NVDA (NVIDIA Corporation), and the technical pattern known as ‘Mag 7’, and understand how they are ‘breaking down’.

NVDA, a multinational tech company renowned for designing graphic processing units, has been known for its hitherto stable performance. However, analysts have started observing a break down pattern in its trend. The ‘Mag 7’ pattern, which denotes a peak that is not only higher but also farther from the zero-line than any other peak in the indicator’s lookback period, is no longer holding true for NVDA.

The break down of the ‘Mag 7’ pattern for NVDA signifies an issue in the stock’s momentum. The shift in momentum might be more relevant than the actual price in predicting the stock’s future direction. Definitely, this drop could imply that there is a bearish bias where the sellers are seemingly taking control from the buyers.

Now, let’s discuss the silver lining in this cloud; the bullish indicators coming in from Russell 2000 and Retail, demonstrating the rather diversified nature of the stock market.

The Russell 2000 (IWM), an index that encompasses small-cap companies, is illustrating a ‘Silver Cross’ buy signal, promising for those investors who endeavor on under-the-radar stocks. A ‘Silver Cross’ is a technical indicator that signifies a bullish market when a short-term moving average crosses a long-term moving average. This signal is perceived as a positive sign, including potential indicators of a future bullish market trend. For IWM, this is a positive and might indicate an uptick in the performance of smaller companies, a hopeful sign for the broader market.

Similarly, the Retail sector (IYT) has also signaled a ‘Silver Cross’ buy signal. The Retail Sector has struck a windfall during the pandemic era with a surge in e-commerce and rapid digital transformations. Paired with the coming holiday season, this bullish signal is welcomed news for investors, implying a possible surge in retail stocks.

In conclusion, the ‘Silver Cross’ buy signals seen in Russell 2000 and the Retail sector hint at a bullish trend for these areas. In contrast, the ‘Mag 7’ breakdown for NVDA underlines a possible bearish tilt. These contrasting signals demonstrate the complex and dynamic nature of the stock market, reminding us of the importance of a diversified investment strategy. The varying performances elucidate the multi-faceted layers of the economic recovery, bearing testimony to the immeasurable, incalculable forces shaping the market’s trajectory every trading day.