The financial market in today’s fast-paced, technology-driven world operates on complex mechanisms. One critical metric that dominates these mechanisms, especially in the United States, is the S&P 500 index. The index, involving 500 of the largest publicly-traded American corporations, serves as a representative snapshot of U.S. equity markets. Recently, the S&P 500 has been continually setting new record highs, sparking a significant dialogue. Interestingly, the root cause of these new highs does not seem to be ‘growth’ as per conventional belief, but rather ‘value.’

Decoding the ‘Value vs. Growth’ Paradigm

Traditionally, growth and value are two fundamental investing styles. Growth investing involves buying stocks of companies expected to grow at an above-average rate compared to other stocks. In contrast, value investing involves purchasing stocks appearing undervalued compared to their intrinsic value. In simpler terms, growth investing is like betting on a company’s potential, while value investing is akin to finding a diamond in the rough. This unique divergence of new record highs in S&P 500 being accredited to value and not growth calls for an in-depth understanding.

The Reign of Value Stocks

Various market studies indicate a shift from growth to value orientation in recent months. Value stocks have been the primary driver of the strong performance of the S&P 500. Companies operating in sectors such as financial services, energy, and non-consumer discretionary are prime examples of value stocks that have been outshining the broad market index, resulting in this upward trend.

In the backdrop of an improving economy and rising expectations for inflation and interest rates, financial and energy companies, usually considered value stocks, have seen significant upswings. These sectors have reaped the benefits of the increasing commodity prices and interest rates, translating their robust profits into superior stock performance.

The energy sector, thanks to the rebounding oil prices, has posted significant gains. Simultaneously, financial companies have capitalized on the rising bond yields, which are set to boost their net interest income. These factors have collectively pushed value sectors to new highs, leaving their growth counterparts behind.

The Underperformance of Growth Stocks

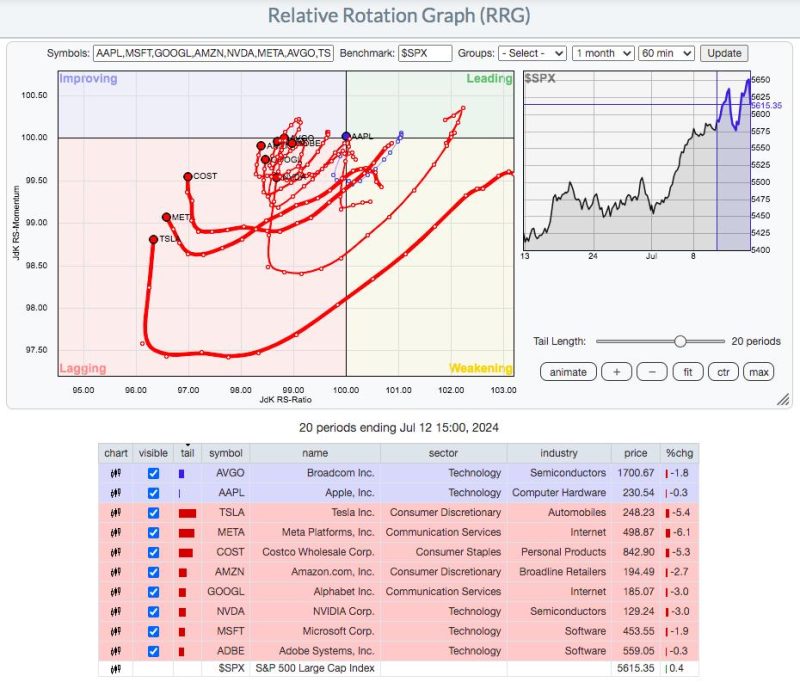

On the other hand, growth stocks that have primarily fueled the stock market’s rally in recent years, especially amid the pandemic, are currently in a phase of underperformance. Tech stocks, a significant subset of growth stocks, have provided lower returns in recent months. The slowdown can be attributed mainly to the challenge posed by rising bond yields, which have made these high-valuation companies less attractive to investors.

Furthermore, the rotation towards value stocks has also been fueled by the anticipation of an economic recovery. As the global economy recovers from the debilitating effects of COVID-19, investors are increasingly leaning towards traditional value sectors. The optimism regarding economic recovery has diminished the appeal of defensive growth stocks, which usually thrive in a low-interest rate environment.

In summary, while the S&P 500 continues to climb to new heights, it is the value stocks that are driving this surge, not the growth stocks. The dynamics may mark the beginning of a new trajectory, where value investments outshine high-growth tech stocks. This shift paints a vivid picture of the ever-changing landscape of finance and the stock markets, offering intriguing insight for market enthusiasts and investors alike.