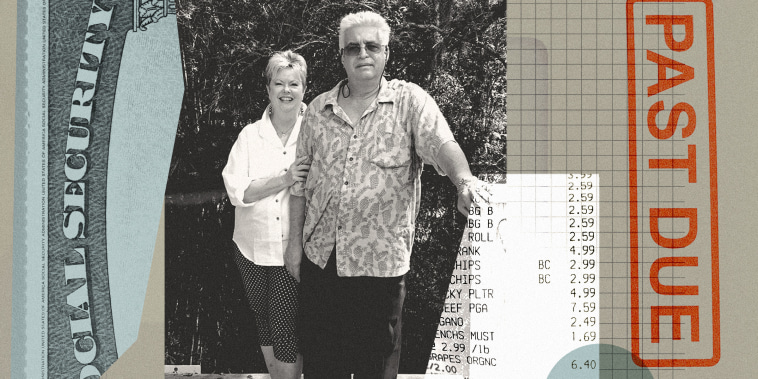

When envisioning retirement, most visualize endless sunshine-filled days, tranquil beach scenes, and stress-free living away from the clamor of a busy professional life. Sadly, this idylifestyle isn’t the reality for everyone — certainly not for meg Thomas, a retiree in sunny Florida who is currently getting by on a $2,400 monthly budget. Despite retiring to a state known for its retirement-friendly communities and idyllic natural beauty, Thomas’s golden years are far from the worry-free paradise she had anticipated.

It’s a stark contrast with expectations. One of the main reasons individuals painstakingly save for retirement is to maintain a comfortable lifestyle, free from the hassles of financial fears and uncertainties. Yet, a disruption in these plans can turn ‘restful’ into ‘stressful’ in no time. For Thomas, her well-laid plans dramatically shifted when her savings completely drained, leaving her with limited resources to manage her needs.

For elderly individuals like Thomas, the decline in savings may have been due to a variety of reasons such as health emergencies, unexpected expenses, or simply inadequate planning during pre-retirement years. It’s a scenario that isn’t unusual but extremely challenging to navigate, thus resulting in long years of retirement overshadowed by constant money concerns.

Like many retirees, Thomas had hoped to spend her retirement taking part in her hobbies, traveling, and spending time with her grandchildren. Instead, she now finds herself budgeting every penny of her $2,400 monthly income. This lifestyle leads to less freedom, less enjoyment, and considerably more financial stress than she bargained for.

Moreover, the retirement-life financial strain has forced her to allocate her limited resources meticulously. She has become an expert at identifying the difference between her needs and wants. Luxuries like dining at upscale restaurants have been replaced with simple home-cooked meals. Instead of social events or club memberships, she turns to free or low-cost entertainment, such as public library events or outdoor activities.

While the financial constraints are undoubtedly overwhelming, Thomas must also contend with a feeling common among retirees living within similar means: the feeling of missing out. This overwhelming sentiment is a stark reminder that her current financial situation is drastically different compared to her expectations. Consequently, her golden years might seem a little less lustrous, the tranquil beach scenes replaced by an ocean of worry and uncertainty.

Yet, despite the challenges that this financial pressure puts on her, Thomas continues to display commendable resilience and adaptability. She embodies the hardships many retirees face when their economic circumstances fall short of expectations.

Overall, Thomas’s situation provides a broader perspective of what retirement could look like when savings run dry. It serves as a poignant reminder of the importance of prudent financial planning and the need to prepare for unexpected turns even during retirement. While her reality may not be a retirement dream come true, her strength in overcoming financial difficulty serves as a testament to the endurance of the human spirit in the face of adversity. Her story contributes to the ongoing conversation about retirement reality, enabling future retirees to plan better and hopefully avoid the tough circumstances she is confronting now.