As we delve into the heart of the matter, it’s important to first understand that the stock market largely operates on expectations, sentiments, and trends. An important trend to recognize is the equity Go trend, which, until recently, has been showing signs of weakening and has fueled the robust performance of financials.

Stock markets are known for their dynamism, where winners and losers swap places quite frequently. This dynamism is being exemplified currently, as financials have begun to topple the hitherto unbeatable equity Go trend in terms of performance. After a prolonged period of the equity Go trend defining the market’s path, now financials are starting to make a strong statement.

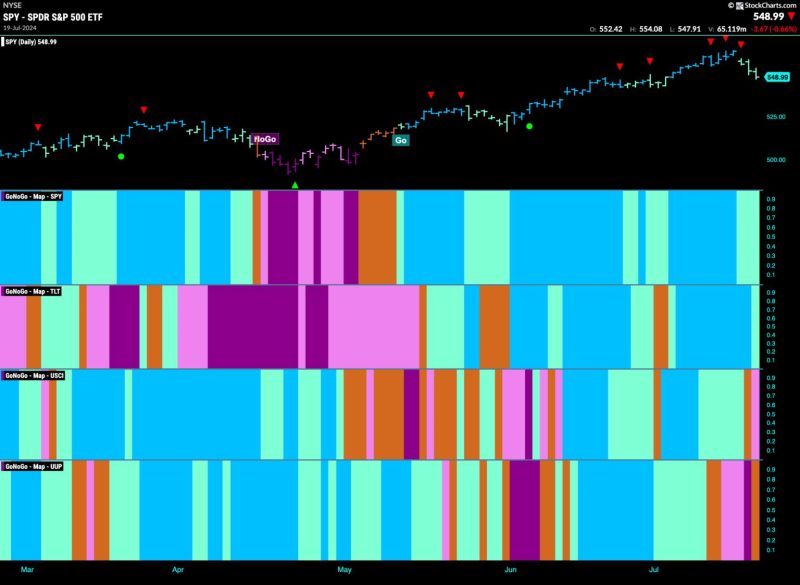

Historically, the equity Go trend has been a symbol of investor risk appetite, heralding the dominance of growth assets over their value counterparts. It has typically been associated with a market willing to shoulder higher risk levels, in return for increased potential for lucrative returns. However, this trend has started showing signs of weakening. This is evident from the recent tilt of the market towards prudent risk management over higher-risk decisions, indicating a more conscious approach to investing.

This shift in preference has opened the floor for financials. With an increased cautiousness from investors, banking and other financial institutions have been view as viable options. The stability and regular income that financial stocks provide, coupled with their often undervalued status have made them an attractive alternative.

Moreover, we are also seeing several financial firms reporting better-than-expected earnings, which has only served to enhance their influence. It’s not just the earnings; factors such as better capital ratios, strong balance sheets and a favourable interest rate environment have also affected this outperformance.

In parallel, Central Banks around the globe have implemented accommodative monetary policies, indirectly boosting the prospects of financials. Low-interest rates usually squeeze the profit margins of banks, but the forecasted tightening of monetary policy is being seen as an advantageous environment for most financial institutions.

Furthermore, with the increasing focus on digitalisation, many financial firms are updating the way they operate, using technology as a lever to optimise operations and attract customers. The pandemic has also played a significant role in accelerating these changes.

This is not to say that the equity Go trend has been completely overshadowed or has ceased to exist. On the contrary, it is still very much alive but has largely been on a back foot as financials continue their upward march.

The shift from equity “Go” trend to financials does not come as a surprise. In the ever-evolving market landscape, such turns of events are not uncommon. It is merely a testament to the cyclical nature of the market trends and the ever-changing investor preferences.

In conclusion, the recent outperformance of financials over the equity Go trend demonstrates the fluidity of market dynamics and the continuous evolution of investor behaviour. For the foreseeable future, though, it seems the financial sector is well-poised to continue its outperformance, but market players must be cautious and attentive to new trends as they emerge. In the end, following a broad, diversified investment strategy remains the best way to navigate and potentially thrive in the ever-changing market dynamics.