The underlying structure of financial institutions and the Federal Reserve’s dominance in managing the United States’ economic policy is a source of continuous debate amongst economists. The subject of the Federal Reserve and its decisions, specifically regarding its toll on the nation’s economy and the public, is a profound and multifaceted one. A close look at the topic allows for an examination of the perceived headache the Fed seems to be creating, positioning us, the unsuspecting public, as the puppets in their grand marionette show.

The Federal Reserve’s underlying impact on the economy is undeniable. Established to maintain the country’s financial stability and integrity, the U.S. Federal Reserve holds a significant role: manipulating monetary policy, supervising and regulating banks, providing financial services, and preserving financial stability. However, their processes have been consequential and not necessarily beneficial for the common people.

The lingering aftermath of the 2008 financial crisis offers a clear lens into this monetary phenomenon. The Fed essentially bailed out the banks, ostensibly to prevent an even worse economic depression. While this decision did salvage the global financial system, it also led to significant changes in the monetary policy paradigm. The bailout’s aftermath saw the rise in wealth concentration among the super-wealthy and the ballooning of an already large gap between the rich and poor. This growing inequality paints a grim picture of how Fed’s decisions can be skewed and favor the wealthy, leading to the average citizen feeling fearfully tethered to industry giants who operate under seemingly separate rules.

Furthermore, the Federal Reserve’s monetary policies have prompted unprecedented economic effects that some critics argue are essentially creating an ongoing ‘economic nightmare’. The long-held conventional strategy of manipulating interest rates to stabilize the economy has given way to more aggressive measures, such as ‘Quantitative Easing’ (QE). This controversial policy involves the Fed buying government bonds or other financial assets to stimulate economic activity. While initially successful in normalizing after the 2008 crisis, sustained quantitative easing led to the accumulation of vast debt loads with little viable plan for unwinding these positions.

But how does this policy place us, the ordinary citizen, as the puppets? It disrupts normalcy by creating economic conditions that make us vulnerable to every decision taken by the Fed. By intervening in the economy and essentially printing money, it stakes the value of our savings and pensions on the stock market, which is known to be extremely volatile.

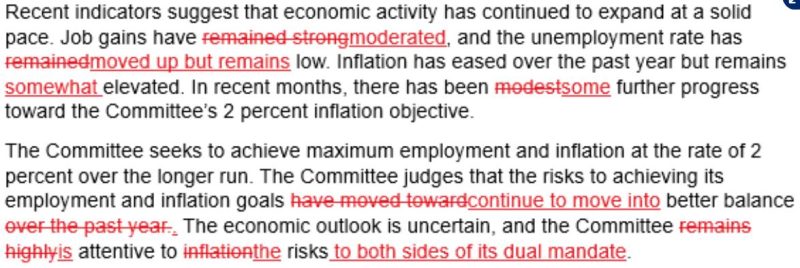

Another clear thread joining the puppet to the puppeteer is the persistent devaluation of the dollar, an adverse effect of the inflation that Fed’s policies provoke. Constant adjustments to the interest rates and increased money supply through QE strategies devalue the dollar. The ensuing inflation eases debts but erodes average citizens’ purchasing power, leaving them in economic hardship.

These are just some of the ways that the Federal Reserve’s actions affect the economy and its participants. Though the impact is complicated, multi-tiered, and frequently hidden in financial jargon, it remains very real, touching the lives of ordinary citizens in myriad unsuspecting ways. The overarching narrative places the Fed as the orchestrator, maneuvering the economy to its tune, while the general public bears the brunt of these policies. In this narrative, it is apparent that we feature not as empowered participants in this crucial arena of our lives, but as unwitting puppets, jerked on the strings pulled by a faceless giant.

Of course, not all discussions involving the Federal Reserve involve gloom and marionettes. There are those who find robust arguments supporting its modus operandi and policy toolkit. These supporters argue that without the interventions and proactive policies, including the controversial QE, the economic landscape might look much bleaker than it is today.

The dialectic between the Fed and the economy underscores the critical task of striking a balance between interventionism and financial autonomy, a balance that neither tips the scales towards freefalling economic crises nor shackles the public as the puppet in a financial pantomime.