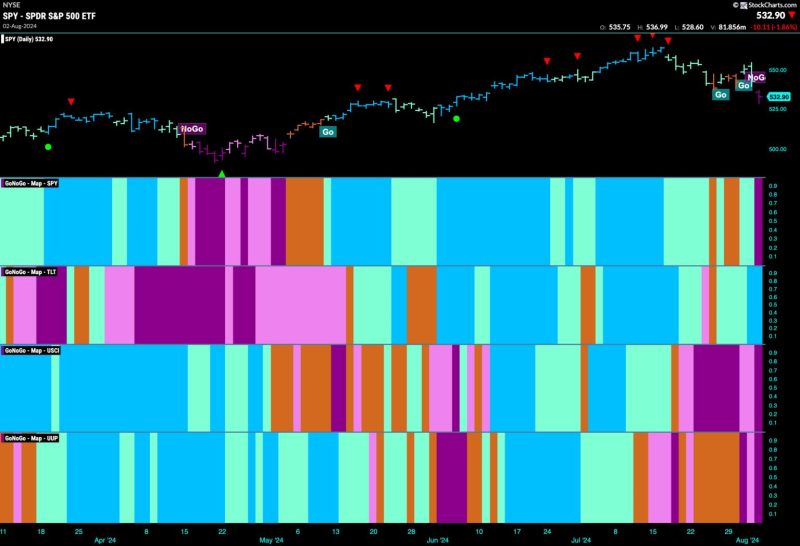

As the market index enters the “NoGo” phase, investors find themselves delving deeper into the complexity of stock market equilibrate. This phase is when the market’s fluctuation makes it difficult for investors to predict and analyze trends efficiently. In such challenging times, the investors go defensive. Getting defensive refers to the shift in the investment strategies of the market participants towards safer and less volatile stocks.

The first facet we observe in such conditions is the preference for Blue-chip companies. Blue-chip companies are typically leaders in their respective sectors, boasting reliable returns and strong financial standing. Leading firms often exhibit safer investment propositions, making it an attractive option for investors who want to avoid the uncertainty of the volatile markets. They offer dividends that provide a steady income stream, thus maintaining some level of return even in difficult situations.

Secondly, defensive investing also involves a tilt towards defensive sectors. These sectors include utilities, healthcare, and consumer staples – areas where demand remains relatively stable regardless of the overall economy. As consumers will always require basic necessities, products, and services provided by these sectors continue to be in demand, effectively insulating them from the worst market downturns. Stocks of such companies can provide a cushion against market volatilities, further reinforcing the appeal for investors.

A critical element of a defensive strategy in a “NoGo” phase is the emphasis on value investing. This principle involves selecting shares that appear undervalued by the market. These stocks, typically characterized by low price-to-earnings (P/E) ratios, high dividend yields, or low price-to-book ratios, are believed to provide substantial safety margins. An inherent belief in value investing is that the market overreacts to good and bad news, resulting in stock price movements that do not correspond to a company’s long-term fundamentals.

In addition to these, diversification is a significant consideration when defensive. By holding a diverse portfolio spanning across various sectors and geographies, investors can spread the risk associated with any single investment. This strategy provides some insulation against the markets’ unfavorable movements, significantly reducing the potential for significant financial loss.

Bond investment also becomes a notable consideration. Bonds, government or corporate, are perceived as safer than stocks, offering guaranteed returns in the form of periodic interest payments and the return of the principal amount upon maturity. The downside to bonds is their relatively lower returns compared to stocks.

In essence, the NoGo phase of the market forces investors to review their strategies and go defensive. This phase reflects the inherent nature of the stock market – its unpredictable, dynamic character. However, it also underlines the value of adeptness, foresight, and the ability to adapt a flexible yet robust investing strategy that can weather any phase the market may enter. Ultimately, the principle of not putting all your eggs in one basket, adequately summates this approach to investing in the NoGo phase.