Broad-based stock market selloff happens when investors sell off a substantial portion of their investments, resulting in a sharp decline in most sectors of the market. Such selloffs typically occur when there’s widespread pessimism among investors, which can be triggered by a variety of factors such as economic downturns, geopolitical conflicts, or major financial scandals.

When a broad-based selloff takes place, even the most reserved investors find themselves caught in the wide-reaching impact. However, while it may seem like a difficult situation to navigate, a well-positioned portfolio can not only endure such a market turbulence, but also pave the way to potential profit when markets normalize. Let’s look at how you can fortify and position your portfolio to weather a broad-based stock market selloff.

1. Diversification:

Diversification is an essential precondition to handling market selloffs efficiently. By spreading investments across a variety of asset classes, sectors, and geographic regions, you reduce the risk of your portfolio being severely affected by a fall in any one area. For instance, stocks often do poorly during sell-offs, but bonds often hold their value or even appreciate during these times, so having a mix of both can help protect your portfolio.

2. Overweight on non-correlated or low-correlated assets:

Assets that have low correlation or no correlation with each other can help mitigate the impact of a market selloff. If one asset class falls dramatically, the other might remain stable or even appreciate, thereby lowering the cumulative loss of the portfolio. Precious metals, certain types of bonds, and even certain types of stocks often have low correlation and can be valuable additions to the portfolio. Similarly, inverse exchange-traded funds (which increase in value when a particular market index decreases) can also provide hedge during a selloff.

3. High-quality Value Stocks:

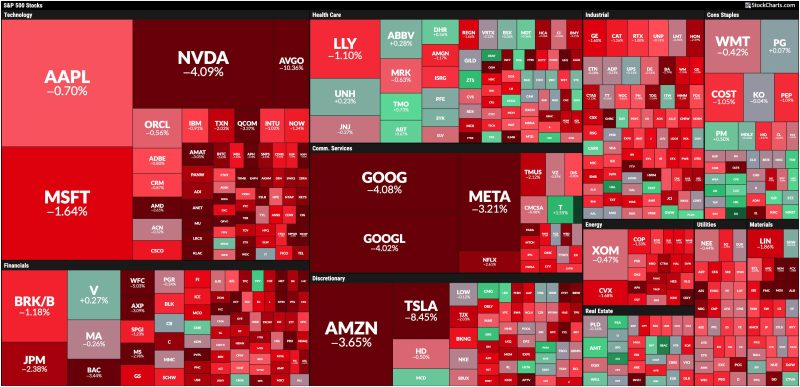

In a broad-based selloff, stocks across all sectors and industries would take a hit. However, high-quality value stocks – those which are considered underpriced relative to their intrinsic value – are often more resistance to market downturns. Such stocks are typically characterized by companies that have stable earnings, low debt levels, and strong profit margins.

4. Cash and Cash Equivalents:

Keeping a part of your portfolio in cash or cash equivalents allows you an element of stability and further lends weight to your portfolio. This not only provides a buffer during market selloffs but also allows an opportunity to buy attractive stocks at lower prices during a downturn.

5. Stop-Loss Orders:

Setting a stop-loss order can automatically sell a security when it reaches a predetermined price. This strategy can help limit the damage to your portfolio during a broad-based selloff.

6. Consider Defensive Sectors:

Certain sectors are known to be defensive in nature as they provide goods and services that are always in demand, irrespective of the market situation, like utilities, healthcare, and consumer staples. Stocks from these sectors tend to outperform during downturns and provide a certain level of protection against selloffs.

In summary, a broad-based market selloff can seem intimidating, but strategic positioning of a portfolio can help mitigate risks while providing potential for long-term gains. It’s worth noting that these strategies must be tuned according to individual risk tolerance, investment horizon, and financial goals. Consulting a financial advisor may also be helpful to make informed and insightful decisions.