Unforeseen changes loom on the horizon as the National Stock Exchange of India (NSE)’s Nifty 50 is showing the preliminary signs of a possible disruption of its uptrend. This analysis may hold the key to navigating the tricky waters that might be presented during the upcoming weeks.

The Nifty 50, NSE’s benchmark broad-based stock market index for the Indian equity market, has been giving prospective investors a rather upbeat feel for the past while. This is due to a marked and continuous upward trend that has been evident during the last few quarters, despite the troubling ripples caused by the ongoing pandemic. However, the skies may not stay clear for long, as initial indicators suggest a possible disruption to the steady rise.

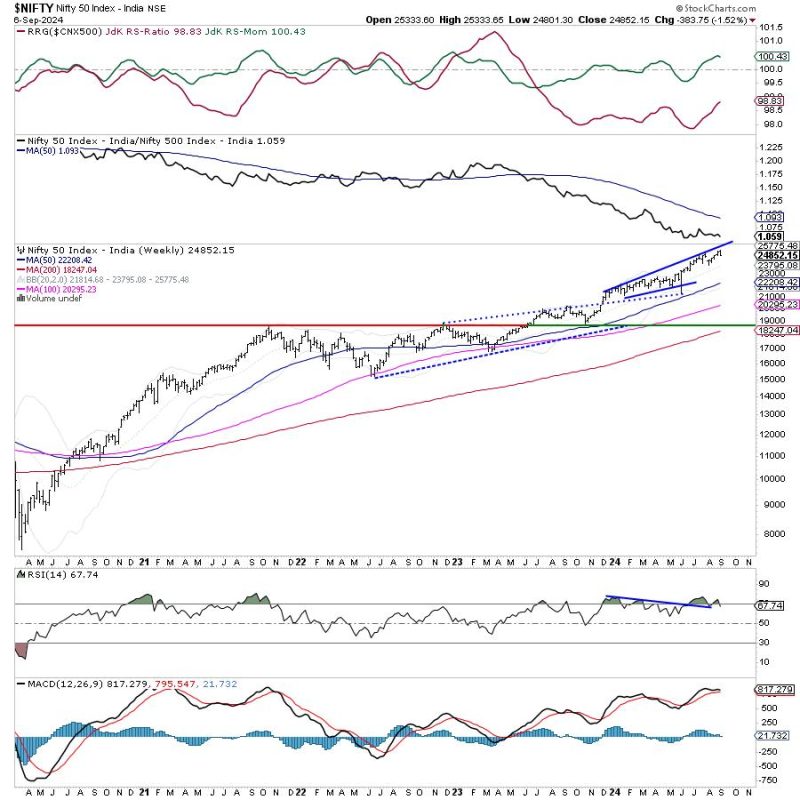

One of the first signs of this impending downturn may hinge on indicators from the Relative Strength Index or RSI. This is among the most common tools used by traders to gauge the price momentum and evaluate overbought or oversold conditions in a trading market. Lately, the divergence in daily RSI is hinting at some weakness ahead. The significant factor to note here is that while the NIFTY continued to pile up incremental highs, the RSI has contradicted this, and has not followed suit.

Further, the pattern analysis suggests that the NIFTY has moved out of a rising channel. Technically, this points toward the conclusion that the uptrend is getting disrupted. The rising channel, which is marked by a series of higher highs and higher lows, is crucial to keeping the uptrend intact. Breaking of this pattern may imply that the dominance of the bulls, so far enjoyed, could be shifting terrain.

In the domain of price analysis, the NIFTY 50 has also closed beyond its crucial Moving Average (MA), a factor that has traditionally been linked to the beginning of a downslide. With this clue, there is the potential that the NIFTY’s winning last streak might cease in the not-distant future unless corrective measures can be expeditiously executed.

Studies about the Volatility Index (VIX) can also corroborate the likelihood of a turbulent week ahead. An increase in volatility commonly suggests higher potential for a downturn. In the case of the NIFTY, a rise in volatility has been recently reported, which further imparts a note of caution.

Despite these early tremors of concern, it’s imperative to tread cautiously until any firm predictions can be made, particularly considering the erratic nature of the market during the last few months. It’s also worth keeping in mind the influence of global cues, especially with the existing volatile global economic scenario.

Lastly, the trade set-up for the upcoming week reflects a cautious outlook. The stocks that had a significant contribution to the gains might not continue the same performance, hence, the rescue efforts might need to be shifted to other sectors. Traders and investors should keep a close watch on the fluid developments in the market, prepare for any volatility and consider potential hedges to their portfolio to mitigate possible losses.

In conclusion, while the NIFTY has had a sparkling run thus far, it is essential to take note of these early signs of a likely disruption in the uptrend. A strategic and well-thought-out approach should be considered by traders and investors to navigate the possibility of turbulent waters in the week ahead.