As we dive deeper into the world of business and economics, one can’t help but notice the recurrence of certain events or rather, a sense of déjà vu within specific sectors. Unfolding this phenomenon, we cast a spotlight on the Consumer Staples sector. This sector, which comprises of companies that produce or sell essentials like food, beverages, and household items, is providing an interesting spectacle by sending significant warning signals. These signals could very well indicate a shift in economic patterns, investor sentiment or upcoming adversity.

In the recent past, the Consumer Staples sector has shown noticeable signs of déjà vu, particularly reminiscent of the markets prior to the 2008 global financial crisis. In light of this, investors and market analysts around the globe are sitting up to take notice of the potential warning signs this could be presenting.

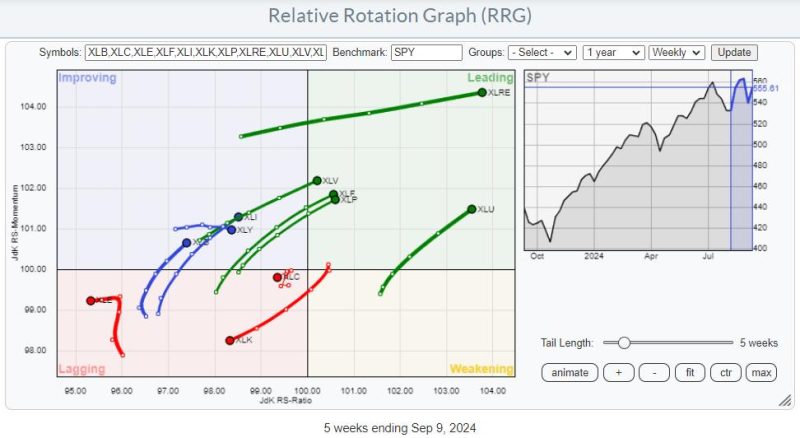

The first warning signal stems from an increase in the relative performance of the Consumer Staples sector compared to the broader market. Normally, this sector is seen as a defensive bulwark; a safe haven for investors to park their money during times of uncertainty or upcoming economic turbulence. As such, outperformance of this sector often corresponds with an apprehensive investor sentiment.

Historically, a surge in this sector has been closely tied with periods of economic downturns or recessions. For instance, in the prelude to the 2008 financial crisis and the 2000 dot-com bubble burst, the Consumer Staples sector showed a similar pattern of outperformance. This surge is often viewed as an early warning sign, indicating investors’ shift towards more stable, less cyclically-exposed sectors in anticipation of a market downturn.

The second warning signal being flashed by the Consumer Staples sector is a sudden spike in the prices of consumer goods. The sector is closely tied to inflation rates, with manufacturers often passing increased costs onto consumers. A persistent rise in consumer goods prices without a corresponding increase in consumers’ purchasing power can be a harbinger of tough economic times ahead.

Rising inflation without corresponding economic growth also leads to stagflation, a scenario where stagnation and inflation coexist. If left unchecked, this could result in a severe economic downturn – a situation any economy would want to avoid.

The third signal comes from the increasing reliance on debt within this sector. Many consumer staples companies have started to take on more debt to fund acquisitions and shareholder returns. This can be an efficient way to fuel short-term growth, but if left unchecked, can lead to trouble when the economy slows and interest rates rise.

Finally, major restructuring within several big players in the Consumer Staples sector signals a need for survival rather than growth. Companies are finding the need to streamline operations, cut costs, and sell non-core business units to stay afloat.

In view of these signals, it becomes vital for investors to be cautious while making their decisions. Consumer Staples sector is demonstrating the classic symptoms of a sector in distress, mirroring the pattern from incidents of past crisis. These warning signs should not be brushed aside, and while they may not necessarily indicate an imminent disaster, they certainly suggest the need for vigilance.

History, as they say, repeats itself, and the déjà vu in the Consumer Staples sector certainly seems to echo this sentiment. It offers valuable lessons to discerning investors, economic analysts, and policymakers. It alerts them of the possible turbulence lying ahead, prompting them to brace for impact or perhaps, more optimally, to take evasive action.