Section 1: Understanding Market Overvaluation in Q2 2024 Earnings

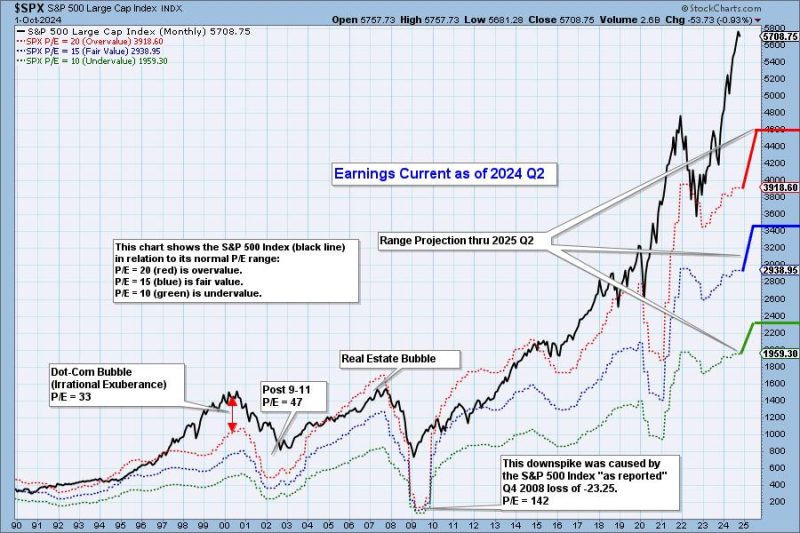

Market overvaluation implies that stocks or other assets have inflated prices based on their intrinsic values. It is one of the most significant concerns for investors, and the 2024 Q2 earnings highlight this prevalent issue. The recent financial performance of most firms exceeded expert projections, but despite this, the market remains overvalued.

While performance indicators look positive on the surface, paradoxically, they could signal the approaching tipping point for this overextended market. The earnings results are primarily driven by momentum, sector rotation, and government stimulus rather than fundamental financial health. This situation is similar to what we saw in the late 1990s before the dot-com crash and the 2008 housing bubble crisis, which were triggered by overvalued markets.

Section 2: Monetary Policies and Market Overvaluation

The implementation of various fiscal and monetary policies undertaken as a response to pandemic-induced economic challenges significantly contributes to today’s overvalued market. The record-low interest rates have made borrowing cheaper, prompting an increase in business activities and, by extension, stock prices. Simultaneously, these policies have lowered bond yields, pushing more investors towards the stock market in search of higher returns.

Section 3: Speculative Investing and the Role of Technology

Furthermore, speculative investing, fueled by advancements in technology, has facilitated an overvalued market. In a typical market setting, the stock prices reflect the underlying asset’s future cash inflows. However, with the emergence of trading platforms and reduced barriers to the stock market, emotion and speculation have started dictating prices. Investors have become reliant on the ‘Greater Fool Theory,’ where they buy an overpriced asset intending to sell it later to an even ‘greater fool’ at a higher price.

Section 4: Overvalued Tech Stocks are Leading

The tech industry takes the lead in this overvalued market. The intense trading activity around tech stocks and other growth stocks significantly skewed the market capitalization. For instance, the S&P 500’s growth has been primarily driven by a handful of tech giants. These operating profits outpaced those of other sectors, leading to a disproportionate reflection of the overall market’s value concerning its aggregate economic activity.

Section 5: Implications for Investors

While these inflated valuations can result in high short-term gains, the situation is untenable in the long run. Achieving higher-than-normal returns amid this hyperinflated market can create an illusion of invincibility among investors. Nevertheless, they need to practice caution since the market’s overvaluation often precedes a strong correction or severe downturn.

Accordingly, investors are directed to diversify their portfolio beyond the conventional overvalued sectors. They should also rebalance their portfolios within a defined timeframe or after a significant price movement. Moreover, considering defensive stocks, which can provide constant dividends and have a resilient business model, would be a sound decision in these volatile markets.

To sum up, while the Q2 earnings of 2024 point to a positive market sentiment and strong economic recovery, the sustained overvaluation of the market is concerning. Central Bank policies, speculative investing, and an over-reliance on tech stocks contribute to this sustained overvaluation. Thus, as market participants, investors must approach this situation with due diligence and strategic portfolio management.