As we usher in another week of trading, let’s take a moment to reflect on the performance of the Nifty and contemplate its potential trajectory from a fresh perspective. As of now, the Nifty stands resilient against the backdrop of global economic variables, exhibiting a robust upswing. However, there’s no denying that upcoming economic events could still sway its course.

In the previous week, the Nifty made a commendable climb despite the soft undertones of global market cues. This upswing underscores the strength of local buying sentiments along with robust earnings by Indian corporations. In fact, these dynamics have potentially positioned the Nifty to sustain its positive trend in the coming days.

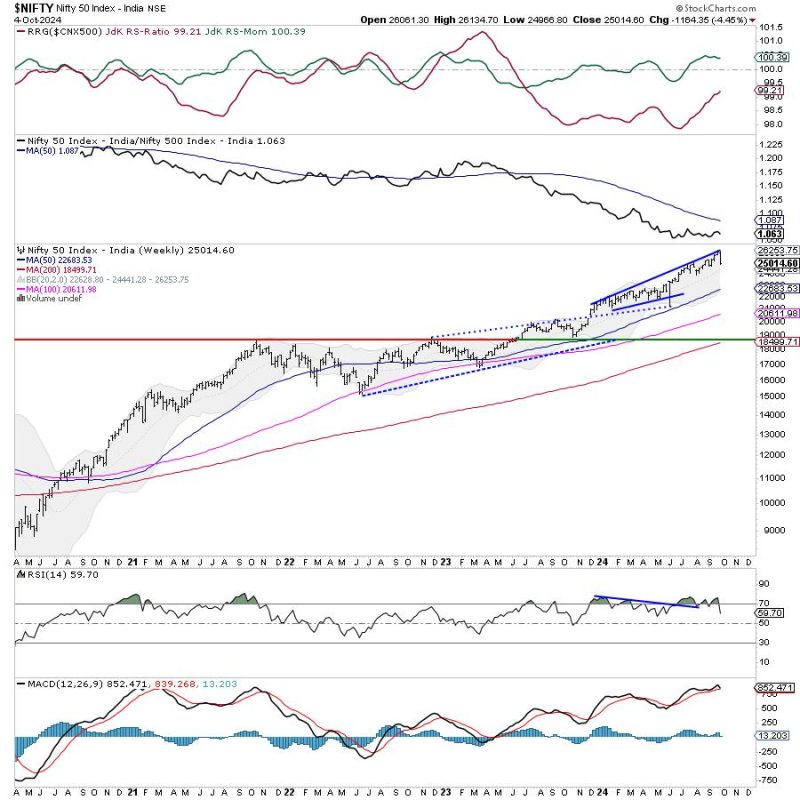

Anchoring on the foundations of technical analysis, we can observe that the Nifty is charting a familiar pattern known among analysts as ‘ascending triangle’, which is a bullish sign. This pattern is often indicative of a strong market sentiment favoring buying, suggesting a potential breakout in the near future. Investors and traders alike should therefore keep a close eye on these patterns to decipher the evolving market narrative.

In the week ahead, macroeconomic factors such as the scheduled release of key economic data along with the ongoing quarterly earnings season are expected to have a significant bearing on market dynamics. Earnings announcements from heavyweight sectors such as banking, IT and pharmaceuticals will particularly draw investors’ attention. As such, these events may very well determine whether the bullish trend continues or we see a potential pull-back.

Further, monetary policy decisions from central banks across the globe, especially U.S. Federal Reserve, European Central Bank, and Bank of Japan, will also weigh on the capital market sentiments and hence the Nifty. Investors would do well to closely watch these developments and understand their implications on the market.

From a contrarian perspective, the fear and greed index, a popular sentiment indicator, is nearing ‘extreme greed.’ Historically, when sentiment reaches such extremes, a short-term market pullback becomes a possibility. This underlines the importance of taking a balanced approach to investing, with a healthy mix of risk and reward in one’s portfolio.

That being said, trading and investing is all about timing, and while the Nifty seems poised for a potentially sustained uptrend, a cautious approach would be pragmatic. In this context, setting clearly defined entry and exit points, maintaining stringent stop losses and having a disciplined approach to money management could go a long way in ensuring successful market navigation.

In summary, despite the Nifty exhibiting quite some resilience and foretelling a favourable trend, market participants are encouraged to approach the next week’s trade with a keen eye for detail, watchful of global cues, earnings announcements and economic releases that could sway market sentiments. Investors would do well to temper their expectations, maintain a measured approach and continue to stay invested in their convictions, even as they eagerly observe the Nifty from this unique vantage point.