Cybersecurity has emerged as an essential facet of the digital era, taking center stage in the ongoing technological revolution. As the trend continues to pick up traction, a new market segment has begun to take form — the Cybersecurity Exchange-Traded Funds (ETF). This article will explore how cybersecurity ETFs have become a living entity in the market, independently evolving with the changing trends in cybersecurity.

Firstly, the rise of cybersecurity ETFs represents a landmark shift in investment practices. Investors are increasingly recognizing the importance of cybersecurity and the potential for this sector to experience significant growth in the future. ETFs serve as an amalgamation of numerous assets and securities bundled together, providing easy and efficient exposure to a particular sector. The creation of cybersecurity ETFs acknowledges this niche as a key player in the modern market, augmented by the undeniable dependence on digital technologies.

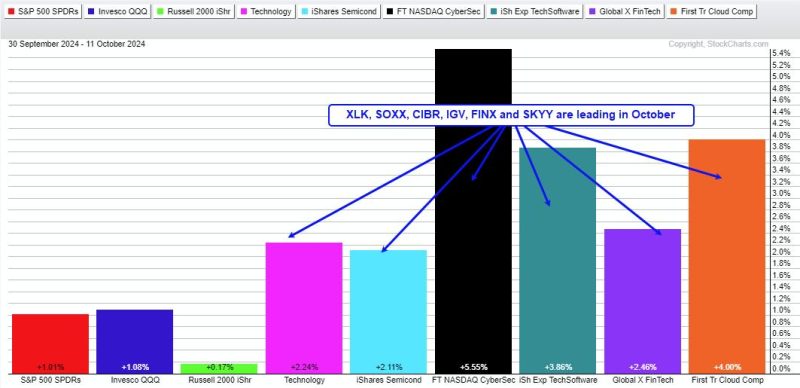

Next, the performance and growth of cybersecurity ETFs are closely tied to the prevailing trends in the global cybersecurity landscape. As cyber threats become more sophisticated and businesses worldwide become more reliant on digital infrastructure, the demand for cyber threat mitigation strategies and systems drastically increases.

One of the key trending aspects driving the cybersecurity sector, and consequently, cybersecurity ETFs, is the adoption of remote work due to the COVID-19 pandemic. With digitalization such an integral part of remote work, businesses have significantly ramped up their online defenses to protect against cyber attacks. As a result, cybersecurity ETFs associated with remote work have seen an unprecedented surge as companies intensify their race towards digital transformation.

Furthermore, with the surge in cyber threats, there’s a concurrent rise in regulatory initiatives worldwide, aiming to protect user data and secure online transactions. Countries and multinational corporations are formulating strict data protection laws. This step is promoting the culture of cybersecurity, thereby aiding in the rise of its market, including the cybersecurity ETFs.

Additionally, emerging and evolving technology trends, such as the Internet of Things (IoT), Artificial Intelligence (AI), blockchain, and 5G technology, are exemplary of areas fostering the growth of the cybersecurity sector. These technologies, while propelling digitalization forward, bring along the side effect of increased security risks that need cybersecurity innovation to neutralize. For instance, AI and Machine Learning (ML) technologies can detect anomalies and suspicious activities, preventing potential breaches. Nevertheless, these areas also require robust cybersecurity solutions to prevent malicious use. This dual role of technology bands bolsters the relevance and vibrancy of cybersecurity ETFs.

Lastly, the growth of privacy-focused products is a major trend influencing cybersecurity ETFs. Big technology giants like Apple, Google are increasingly focusing on making their products with maximum privacy settings, keeping personal data secure. The usage of data encryption, two-factor authentication, and detailed data usage policies are vital markers of a privacy-conscious technology industry. As more organizations orient themselves towards privacy-focused solutions, it bodes well for the cybersecurity sector and the associated ETFs which ride the wave of this trend.

In summary, the life of the cybersecurity ETFs mirrors the ebbs and flows of the cybersecurity landscape. As cyber threats become increasingly sophisticated, the relevance of cybersecurity grows paramount. The trends such as remote work, technology advancement, privacy-focus, and regulation are all leading to massive investment in cybersecurity, creating a thriving environment for cybersecurity ETFs. By addressing the advancements and threats of a digitally driven world, cybersecurity ETFs have truly come to life, echoing the pulse of the new digital paradigm.