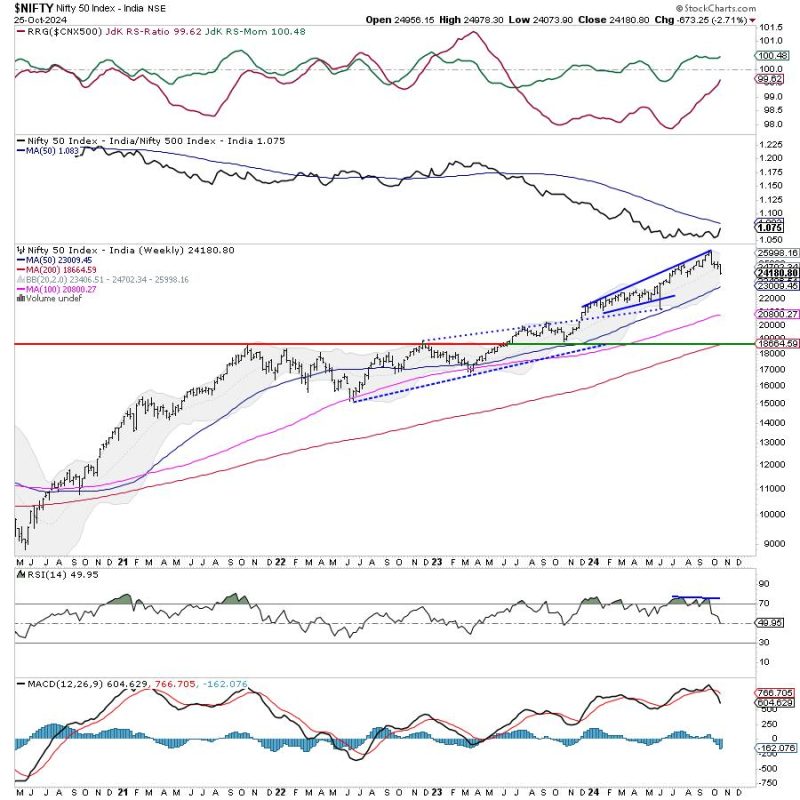

In the ever-dynamic world of stock trading, market trends continue to keep investors on their toes. This past week, one of the notable pulse points that caught the attention of many was the National Stock Exchange’s NIFTY 50 index, which violated key support levels, dragging resistance lower, and pointing towards a significant shift in the market dynamics.

Diving into the details, a crucial development was witnessed during the past week as NIFTY 50 decisively violated its key support levels. Investors worldwide use support levels to understand and measure the level at which the market has historically not fallen below for a specific timeframe. The breaking of these levels is typically seen as a bearish signal, often followed by increased selling pressure.

In the case of NIFTY 50, the violation of the critical support levels not only indicates an increased rate of selling but also shows the vulnerability of the market. When a support level is violated, it usually means a significant number of investors are ready to accept a lower price for their holdings, potentially due to expectations of further downside in the foreseeable future. This move acts as a harbinger for increased bearish sentiment among investors.

Moreover, NIFTY’s violation of the key support levels also dragged down the resistance levels. For the uninitiated, resistance levels denote the price beyond which a security has not risen for a given period. It’s the psychological frontier of the market, evidence of a reluctance or hesitance among investors to purchase stocks at a higher price level. The lowering of resistance levels might be an indication that investors are now expecting lesser bullish momentum and are lowering their thresholds for taking profits.

The downward revision of both support and resistance levels for the NIFTY 50 is a signal to tread cautiously. While it does not necessarily denote a forthcoming recession or a bear market, it does represent an increased probability of a bearish market movement.

Additionally, such a trending shift in NIFTY could have implications on domestic and international investors’ strategies. For domestic investors whose portfolios are primarily driven by the NIFTY 50 index, the key to surviving potential short-term losses and ensuring long-term profitability lies in a diametric shift towards having more hedging strategies in place. On the other hand, international investors might see this as an opportunity to adjust currency hedging strategies since the falling NIFTY could potentially weaken the Indian Rupee against foreign currencies.

Lastly, in these volatile times, it is pertinent that individual retail investors track the market developments more closely, not just for NIFTY 50, but for individual sectoral indices as well. A prudent engagement with the volatility measures like the Market Volatility Index (India VIX), various technical indicators, Moving Averages, Relative Strength Indexes, and Bollinger Bands, can assist in making more informed trading decisions.

In essence, the swift violation of key support levels by the NIFTY 50 and the lowering of resistance levels brings a profound shift in trader sentiment and behaviour. These altered market dynamics beckon a more risk-averse trading strategy, a cautious outlook for short to mid-term trades, and an agile adjustment of investment portfolios. So, as always, the key to mastering these market movements and surfing the waves of volatility is a blend of vigilance, prudence, and adaptability.