The National Stock Exchange (NSE) NIFTY 50, which is a benchmark Indian stock market index consisting of 50 well-established and financially sound companies listed on the National Stock Exchange, is expected to witness a stable start in the coming week. However, it is likely to remain under selling pressure at higher levels due to various factors emerging in both the domestic and international market scenarios.

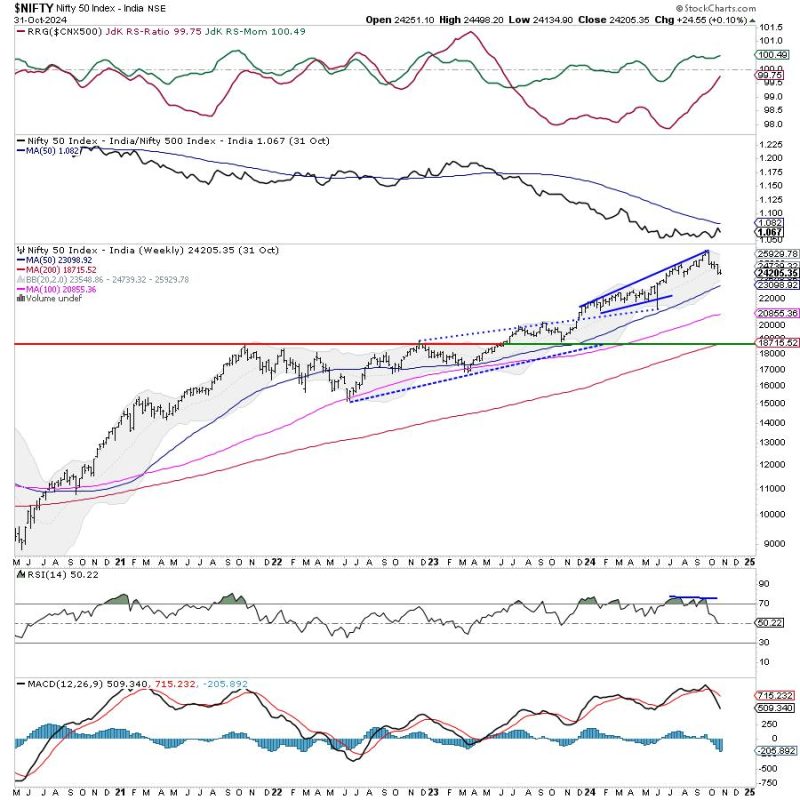

In a technical perspective, the NIFTY 50 has been navigating turbulent waters due to increased volatility, be it due to the ever-changing pandemic situation or major policy decisions made domestically or internationally. Despite these aspects, the week could begin on a stable note. Yet it is essential for market participants to be wary of the fact that at higher levels, there could be a prevalence of selling pressure.

The potential of selling pressure at higher levels can be attributed to multiple factors. For instance, fluctuations in the global economic landscape, fear of inflation, geopolitical tensions, and the central bank’s economic strategies often lead to such market scenarios. The anticipation of a hike in interest rates by the U.S Federal Reserve, tapering of bond purchases, or unpredictable oil prices can contribute to selling pressure in higher levels of the index.

Moreover, the domestic economic situation, which largely touches upon factors such as corporate earnings, economic indicators, government policies, and the Budget, also influence the NIFTY’s performance. An important element to consider here is the Q3 earnings of companies. If it fails to meet market expectations, there could potentially be an outflow of foreign institutional investments (FII), leading to enhanced selling pressure at higher levels.

The banking sector, a vital contributor to the NIFTY, is another area to watch. As it is equally reactive to the ripples in the global and Indian economic ecosystem, any adverse scenarios or policy decisions affecting this sector might prompt selling pressure at higher levels of the index.

Even though the coming week may see a stable start, technical analysts believe that the NIFTY 50 is likely to test its crucial support levels. Investors are suggested to remain cautious and focus on preserving capital and managing risks efficiently rather than aggressive buying. It is also recommended that retailers stay on top of a methodical and disciplined investment approach to tackle any downside risk.

Furthermore, due to the underlying selling pressure, the market breadth will remain crucial. A narrower market breadth often indicates a lack of participation by the majority of the stocks, mainly being driven by a few heavyweights. In periods of high selling pressure, wider market breadth is favorable as it indicates a healthier market scenario.

In conclusion, the coming week will witness a delicate dance between buyers and sellers, where the investors need to tread cautiously. The selling pressure at higher levels might offer a slightly bearish touch to the week, even if it might initially start stable. However, prudence and vigilance remain the key mantras for the investors in these volatile times.