Before diving deep into the core subject, it is important to first understand the fundamental elements associated with it. A ‘bull market’ is a financial market characterized by optimism, investor confidence, and expectations of strong results. Meanwhile, when we discuss a ‘secular’ market, we’re dealing with a market driven by forces that could be in place over several decades, usually lasting between five to 25 years.

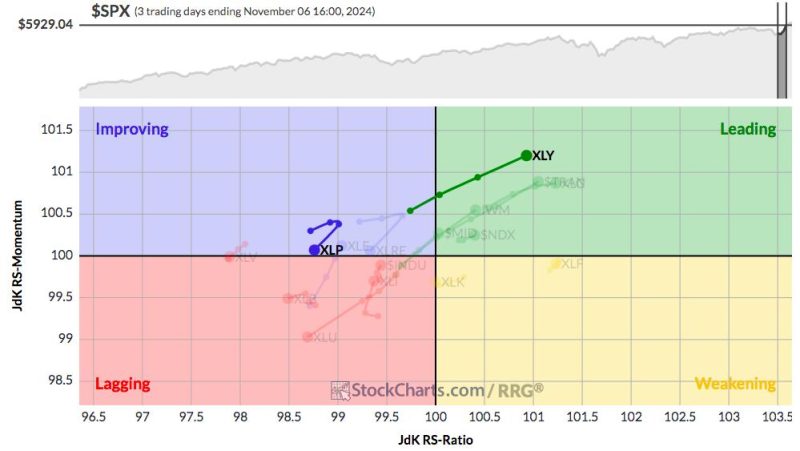

The current financial markets are witnessing an interesting phase where the secular bull market continues, but it does so with major rotations in sectors and market leadership. It is a phase where the overall optimism and investor faith are holding strong, but there is notable movement and shift away from traditional market leaders towards other sectors. This is what we call ‘rotation’.

One of the main catalysts for this rotational shift can be traced back to the Covid-19 pandemic. Amid the havoc wreaked by the pandemic globally, some sectors managed to not only survive but in fact thrive. Ecommerce, digital services, and healthcare sectors blossomed, while traditional sectors such as oil and gas, tourism, and real estate faced the brunt of the impact. This led investors to rotate from the latter to the former, causing a major shift within the bull market.

Another key driver behind this rotation is the technological revolution. As technology continues to advance at an unprecedented rate, it’s transforming a multitude of sectors and attracting considerable investment. Biotech, fintech, AI, and nanotech are increasingly stealing the limelight, therefore leading investors to pivot their focus here from less progressive sectors.

It is also crucial to note the role of government policies and macroeconomic factors in this phenomenon. Development programs, ease of doing business measures, and changes in tariff policies all have significant sway over investor sentiment. They could tilt the balance in favor of a particular sector over another, thus prompting rotation. For instance, positive government policies towards renewable energy may shift focus away from traditional energy sources.

Investors looking to benefit from this shift in the secular bull market need to be extra vigilant. While broader optimism is still intact, tendencies to favor particular sectors can vary due to numerous factors. They must closely monitor trends and market movements and reallocate their portfolios accordingly to make the most of this rotational bull market.

Moreover, risk management, traditionally an essential part of any investment strategy, becomes even more crucial in this scenario. With major rotations occurring, it is important to maintain a balanced portfolio to weather any abrupt sector-specific shocks.

In essence, while we are still in the midst of a secular bull market, significant rotations within are becoming increasingly prominent. The key for investors is to keep a keen eye on these shifts, adapt their strategies accordingly, and understand that while the market might be bullish overall, it doesn’t necessarily hold true uniformly for all sectors.

However, the continuation of the bull market, alongside this rotation, offers promising prospects for investors who can skillfully navigate the shifts. Therefore, it could lead to even more dynamic, resilient, and diverse markets, perhaps becoming a new characteristic of the future financial landscape.