In the coming week, trading activity in the National Stock Exchange of India’s benchmark NIFTY 50 index is predicted to remain slow and uninspiring. The index is likely to remain sluggish due to a multitude of resistance levels which are resting close to each other. This can lead to a bout of volatility, amid an otherwise trendless market.

The NIFTY 50, a broad-based 50-stock free-float market capitalization-weighted index representing varied sectors of India’s economy, is known for its sensitivity to domestic and global events. This week, there exists a cluster of resistance levels, from which the index may face difficulties in achieving a breakout, thereby leading to its predicted slowdown.

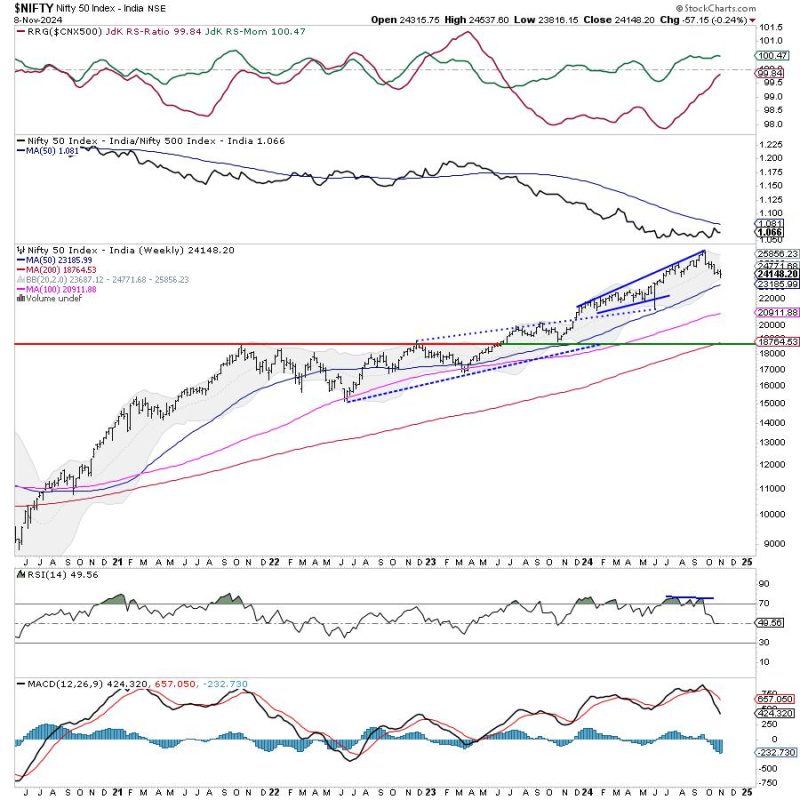

It’s also important to note that the index has been trading closer to its pattern resistance at the higher levels. This implies that the index has been unable to breach this pattern resistance due to lack of adequate buying or increased selling pressure at the higher points. This resultant consolidation activity restricts the upward movements and often results in a sluggish trade.

In technical parlance, this is called a ‘resistance zone’, which essentially means a price level or range that the stock or index might find hard to overcome due to maximum supply (selling pressure). In the present scenario, multiple resistance levels are clustered within a close range. The more the number of resistance points in a zone, the stronger the resistance becomes.

The multiple resistance points that the NIFTY 50 index is facing are located between the range of 15,400 and 15,500. This zone becomes a crucial one given the significant selling pressure that might be encountered in this area. The basic premise of technical analysis is that the price movements often face hurdles at these critical resistance levels, which makes it difficult for the index to move ahead with the same momentum.

Furthermore, while the multiple resistances pose a challenge, there also lies an unseen opportunity. If overcome, these could act as a base from which the NIFTY index may witness a strong leap. For this to happen, it would require a significant trigger, either technical or fundamental, to absorb the selling pressure.

As of now, it can be inferred that the index may continue with its lacklustre performance during the forthcoming week until it can convincingly breach the defined resistance zone. Any sustained move beyond this resistance zone would indeed be a positive development and may push the index towards a new orbit.

However, if the index continues to face selling pressure at the upper range and is unable to breach the resistance zone, we may continue to witness the sluggishness in the markets. For now, traders must watch this zone carefully and monitor the volumes in these levels to gauge the possible trajectory of the NIFTY 50.

Moving forward, careful observation of price action and market indices is recommended. While global cues may influence trading behavior in the short term, in the long run, it is the underlying strength of the economy that determines the direction of the share market. Therefore, traders should not lose focus on the macroeconomic factors and corporate earnings, in order to make informed decisions.

Keep in mind that while the technical analysis underscores potential possibilities, it needs to be interpreted in conjunction with larger market cues and economic factors. This will offer a more comprehensive understanding of trends and assist in achieving more profitable trades. As always, it is imperative for traders and investors to conduct their due diligence and exercise prudence in their market strategies.