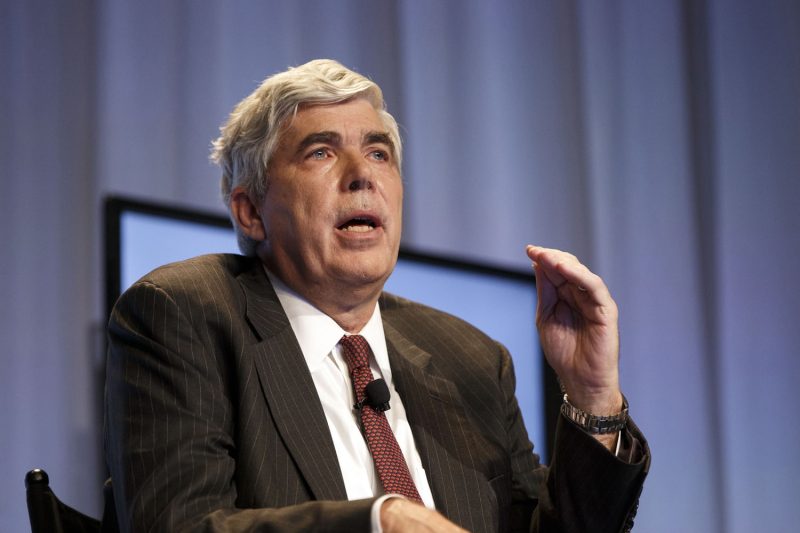

Sub-Head: Kenneth Leech Faced with Fraud Charge

Heading: Profile of the Accused

Kenneth Leech has been a noteworthy figure in the finance industry, primarily due to his former role as the Chief Investment Officer of Western Asset Management Company (Wamco). His executive position at the international firm, which specializes in fixed income management, provided him with significant influence and responsibilities, and his actions are now being scrutinized in the face of recent fraud charges.

Heading: Understanding the Charges

The U.S. Securities and Exchange Commission (SEC) issued charges against Leech in late 2021. The complaint accuses the former Wamco executive of extensive financial misconduct. According to allegations, Leech managed to manipulate prices related to securities in the Wamco fund, thereby causing an inflation of the fund’s net asset value and performance figures. These activities were purportedly concealed from both investors and the firm’s board, painting a picture of deceit and manipulation, leading to actual harm to investors who were potentially misled in their investment decisions.

Heading: More about the Fraudulent Practice

SEC claims that between 2016 and 2018, Leech manipulated the price inputs of certain mortgage-backed securities, subsequently affecting the fund’s net asset value. His actions led to the flawed quoting of the price for these securities on the days when the fund calculated its net asset value, resultantly attracting investors with inflated performance records. This alleged fraudulent activity places a layer of suspicion on Leech’s professional ethics and strikes at the integrity of his position and his ability to execute fiduciary duties.

Heading: The SEC’s Position

The SEC announced that it had charged Leech based on the outcome of its investigation, which revealed his suspected fraudulent activities. According to the SEC’s allegations, Leech’s conduct diverged significantly from the conduct expected of a senior executive. His supposedly misleading and illegal actions not only attracted potential investors but also reportedly increased his bonus compensation. The case stands as an example of the SEC’s active pursuit of justice against individuals and entities suspected of causing harm to investors and undermining the principles of fair and transparent financial markets.

Heading: The Potential Repercussions

The SEC aims to hold Leech accountable for his actions, asking the court for a permanent injunction against him, return of the supposed ill-gotten gains with prejudgment interest and a civil penalty. The potential penalties are quite substantial and signify the seriousness of the situation. If Leech is found guilty, it would serve as an example to other executives and discourage any attempts at manipulative or fraudulent behaviors.

This case offers a pertinent reminder about the responsibilities that come with holding a position of power within an organization. As Kenneth Leech deals with these charges, the financial market and investment community will be watching closely, further underscoring the consequences for executive misconduct, and reaffirming the continued need for investor protection and transparency.