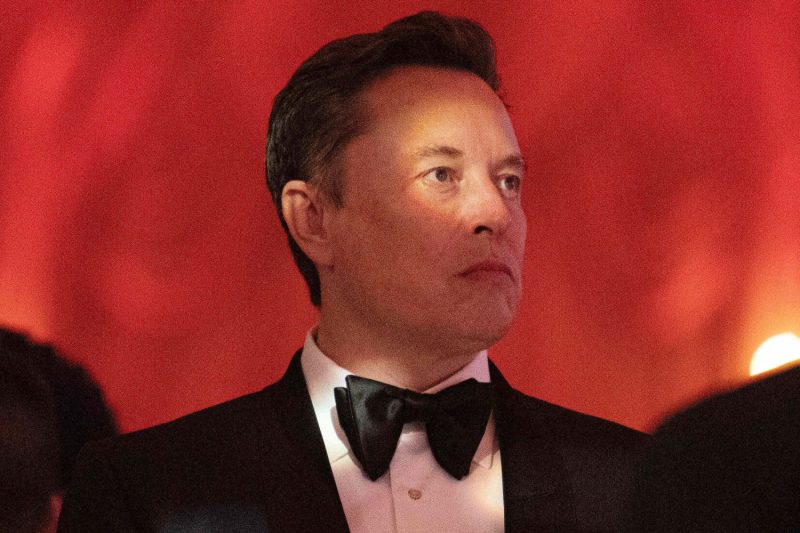

Tesla Chief Executive Officer, Elon Musk, recently lost a bid to reinstate his $56 billion compensation package following a ruling by a judge in Delaware. The decision threw into jeopardy Musk’s claim to receive a landmark sum, which was directly tied to Tesla’s market value, revenue, and earnings targets. Herein lies a sizable narrative around the intricate dynamics at play between corporations and their leaders, executive compensation, and legal complexities.

In 2018, Tesla’s board of directors approved a compensation package for Musk that was worth around $56 billion, one of the largest in U.S corporate history. The package that Musk and his legal team have been fighting to reinstate wasn’t a fixed amount. Rather, it was a ten-year grant of stock options that would vest in 12 tranches, each tied to specific milestones related to Tesla’s growth.

In the wake of this approval, a lawsuit was filed by a shareholder, claiming that the deal breached the fiduciary obligations of the board members, equating it to a waste of corporate assets. The shareholder further argued that the package was unfair to the company and its investors, asserting that it overly compensated Musk at their expense. The trial concluded in July 2021, and the recent ruling marking a major loss for Musk, was largely favouring these arguments.

Tesla’s board of directors had initially defended Musk’s pay package, citing his crucial role in the growth and success of the electric vehicle and clean energy company, and noting that the package was directly tied to him meeting ambitious growth targets. Nevertheless, the judge sided with the shareholder, essentially arguing that the board was at risk of breaching its fiduciary duties by awarding the ambitious compensation package.

According to court documents, the critical issue here wasn’t necessarily whether Musk worth $56 billion but whether the board of Tesla appropriately managed potential conflicts of interest concerning the package. Specific concerns voiced in the lawsuit were around Musk’s brother, Kimbal Musk, who was part of the board approving the pay package and the fact that if all targets were met, Musk could end up owning 28.3% of Tesla, a multi-billion dollar company.

With this decision, Musk is now left without clarity on his future compensation from Tesla. The defeat in court may set a benchmark for executive pay packages in future, serving to potentially curb excessively ambitious payouts, and putting boards of directors under scrutiny for their fiduciary duties. However, the impact on Musk’s leadership or his relationship with Tesla remains to be seen.

This judgement also rattles the broader tech industry, where lavish executive compensation packages have been the norm in order to attract and retain top talent. It introduces the possibility of shareholders pushing back against the trend, and courts affirming their sentiment.

Musk has yet to publicly comment on the decision. However, given his stake in Tesla and his instrumental role in driving the company forward, he remains a critical part of Tesla’s story, irrespective of his remuneration structure.

Collectively, the incident marks a significant development in the arena of executive compensation, illustrating the rising influence of shareholders and courts over boardroom decisions and signaling a potential shift in how corporate leaders are compensated. Not only could this outcome lead to more scrutiny of executive packages, but it might also encourage greater transparency and justification for such packages, ultimately promoting more equitable and effective corporate governance.