In the course of the prior week, we noticed an interesting volatility in NIFTY, wherein the market experienced some profit booking from higher levels. It is important to pay attention to these movements given the predicted market actions in the forthcoming week.

To provide you with a comprehensive understanding, we would evaluate the performance of the market and venture into the possibilities ahead.

The contrasting performance of NIFTY in the last week suggests a state of restlessness in the market. It was observed that the market opened on a positive note, however, towards the end of the week, the index shed all its gains. This reflects a phase of profit booking, pointing towards turbulent market conditions and high volatility. Several traders cashed in on their profits in view of rising uncertainties, which served as a primary reason for the dips in the market.

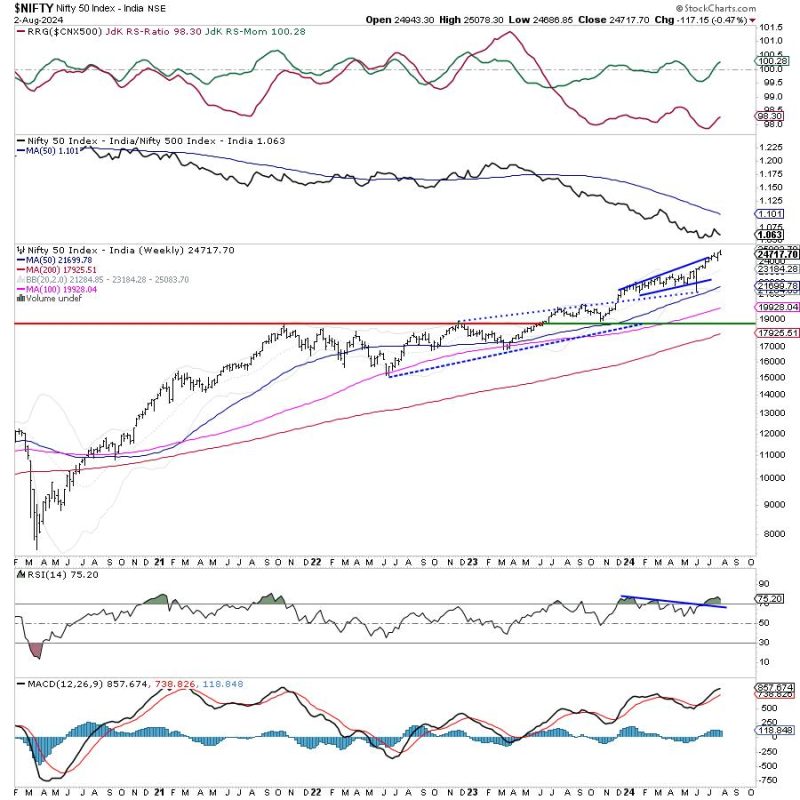

Analysing the weekly market charts, NIFTY has positioned itself below the 20-week moving average. This indicates the current stage of vulnerability and exposes NIFTY towards misguided market actions such as profit-booking bouts. That said, looking ahead, experts have voiced their concerns about the market being prone to undergo a similar situation.

So, what do these profit-taking bouts imply, and how could one possibly guard profits while staying stock-specific?

A surge in profit-taking bouts does not necessarily indicate a bearish market. Instead, it represents the market’s dynamic nature and traders’ propensity to realize their profits at higher levels, distinctly when the market seems unstable. This might be due to several reasons ranging from global announcements to internal market movements which shape our perception of the risk involved.

In scenarios wherein NIFTY is predisposed to such bouts, shielding your profits becomes vital. To do so, traders should opt for a meticulous approach, while staying stock-specific. It is essential to keep an eye on the companies that showcase promising potential and develop an in-depth understanding of the sectors that these companies represent. For instance, IT or Pharma sectors could potentially hold steady even amidst market headwinds.

Being stock-specific is essentially about focusing on individual stocks that display robust fundamentals, regardless of the market conditions. You could potentially shield your profits by investing in companies that have a consistent performance record, solid business models, and promising growth outlooks. This could potentially enable you to navigate through the volatile times with more confidence.

To say, it is also crucial to incorporate the practice of stop-loss orders in your trading habits. This strategy allows the limitation of potential losses by deciding a point of exiting a trade, which could act as an essential marker if the market promptly takes a downturn.

In relation to global markets, it is imperative to keep an eye on them as well. Global indices might offer substantial cues, especially given the profoundly interlinked world economy. As a part of anticipating the market movements, one can potentially look into the leading indicators that provide a broad view of market trends, helping to determine potential inflection points.

Despite the prediction of profit-taking bouts ahead, NIFTY’s market breadth remains inclusive and healthy. Looking ahead, an optimist may see this as an opportunity for the market to realign and stability to potentially restore. It could prove to be an advantageous situation for investors who prefer staying stock-specific, thereby utilising these bouts to their own advantage. It is always advisable to keep an unbiased viewpoint keeping in mind the changing contours of the market.

Therefore, as we drive into the next week, investors should guard their profits judiciously and stay thoughtful towards market indications while being stock-specific. These strategies, if employed effectively, could serve as a robust armor against turbulent market times, aiding you in steering clear of unnecessary losses.