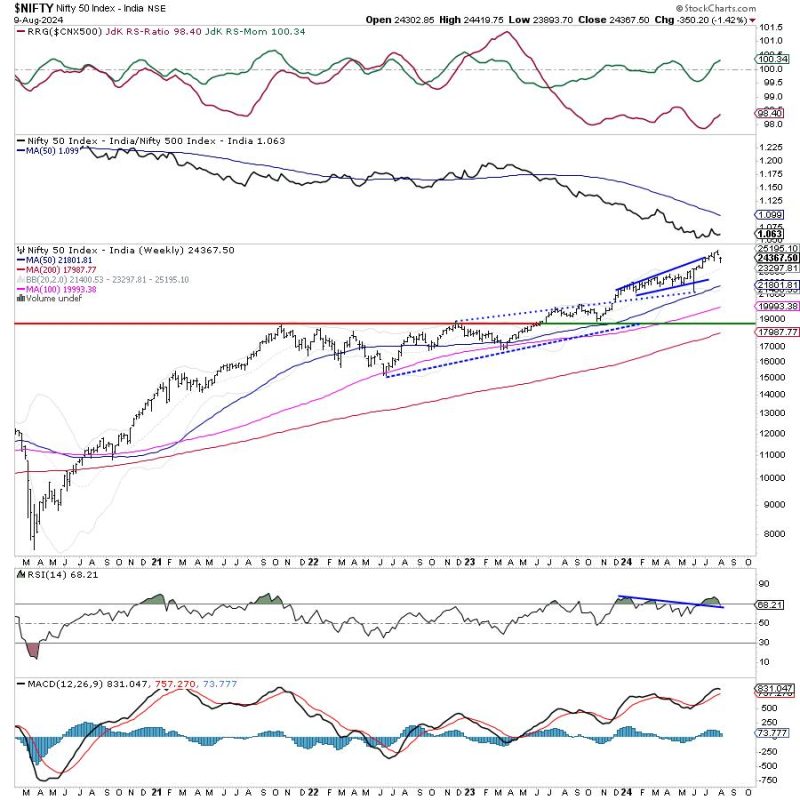

As we look ahead towards next week’s trading activities in the Indian market, we can see that the National Stock Exchange Nifty Index, otherwise known as NIFTY, is currently displaying a tentative nature. This article will delve into exploring the developing defensive setup within the index and highlight crucial levels that investors should keep an eye on.

The first thing that strikes our attention is the delicate balance the NIFTY is currently sitting in. Over the past week, the index has seen a healthy amount of choppy trading sessions reflected by an increase in intraday volatility. The significant factor to note here is the increasing pivoting around its 50-Day Moving Average, suggesting the market’s uncertainty about the direction of this critical benchmark. Hence, the current tentative posture of the NIFTY.

The developing defensive setup in NIFTY is evidenced by its oscillation around key levels, like the 15,500 support level and the 15,800 resistance level. Market participants, both bulls and bears, seem to be in a standstill, awaiting any significant event or statistic that could offer a clear direction. A robust defensive play is to protect the portfolio from significant drawdowns during these uncertain times.

Understandably, investors might concern themselves with these key levels. The 15,500 level has been a robust support level, tested multiple times in recent weeks, and currently acting as the floor. A break below this level could trigger a further sell-off, dragging the index to 15,250 or possibly even 15,000. On the other hand, the tug of war at the 15,800 resistance level continues unabated, and a convincing breakout above this level could likely lead to 16,000 or 16,200 levels.

Aside from index levels, it’s imperative to note the sectoral trend. The defensive nature is most visible in sectors like IT and Pharma, which are perceived as safe havens amid market uncertainty. Meanwhile, sectors like Banking and Realty, which are more cyclical and sensitive to macroeconomic changes, have seen subdued activity.

External factors also come into play, such as global economic conditions and geopolitical tensions. Market participants remain skittish due to uncertainties regarding inflation concerns and variance in COVID-19 cases worldwide. These factors could potentially contribute to the NIFTY’s current state of limbo, as investors wait on bated breath for the next economic update or significant news event that could bring the much-needed clarity.

In conclusion, as we step into the week ahead, the biggest takeaway for investors is to be patient and vigilant. With the NIFTY seemingly stuck in a narrow trading range, focus on the stated levels is paramount. Defensive sectors could offer valuable protection in these fluctuant times. It is crucial to stay updated on prevailing economic conditions and global events, which may introduce new opportunities or threats, to our investment strategies.