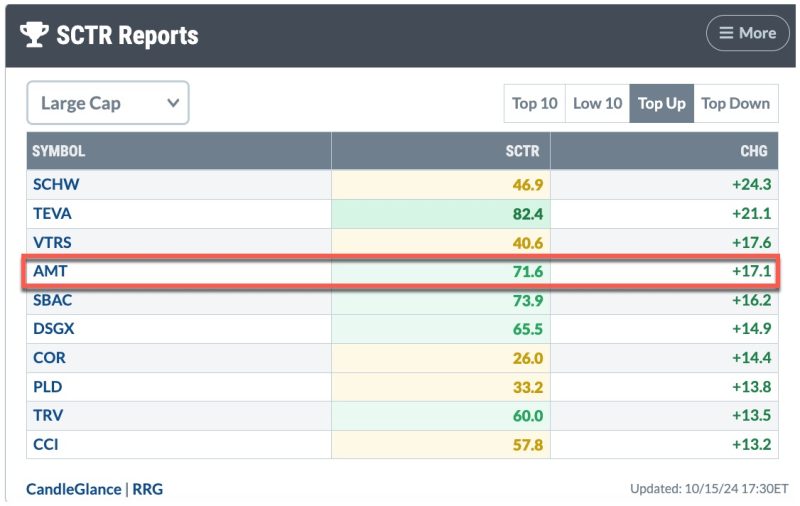

American Tower Corporation, an independent owner, operator, and developer of multi-tenant communications real estate, is gaining traction in the stock market with a massive breakout looming. The company’s stock conglomerate consistently presents exceptional profits derived from managing a portfolio of approximately 181,000 communications sites. As per the recent StockCharts Technical Rank (SCTR) report, American Tower is presenting an excellent buying opportunity for investors right now. Let’s delve into more details.

The SCTR is comprehensive proprietary scoring system for tracking the relative strength of every single stock within the stock market universe. With its history of outperformance and a bullish technical setup, American Tower has entered into the limelight for all the right reasons. On a 100-point scale, the company is currently ranking at an extraordinary score of 99.9. These scores reflect the company’s strong trading characteristics compared to all other publicly traded companies.

American Tower’s steady growth journey is nothing less than inspirational. The company’s impressive growth strategy combined with revenue diversification, incessantly boosts its standing within the market. It leases space on its communication sites to wireless service providers and radio and television broadcast companies. This lucrative business model has helped American Tower to create a recurrent revenue stream. In addition, the rapidly expanding 5G technology promises lucrative avenues of growth for the American Tower, helping the company to broaden its horizon.

Technically speaking, the American Tower stock price has traced a sharp ascending trendline over the past several months. Following a period of consolidation, this breakout is now playing out on massive volumes, indicating widespread participation. This bullish trend could allow an upward spike in the price, presenting a golden window of opportunity for investors to step in.

Moreover, American Tower also offers an excellent dividend yield, standing at around 2%, well-supported by robust free cash flow generation. The company’s forward-looking prospects remain bright, with long-term contracts in place that provide it with a sizable and predictable stream of revenues, thereby allowing it to consistently raise dividends.

The global telecommunications industry is undergoing an unprecedented and revolutionary change with the evolution of 5G technology, making it a star player in post-pandemic economic recovery. Given the critical role that American Tower undertakes within this context, the prospects look shiny for its profitability and consequent return to the investors. With the SCTR report positioning it as a breakout stock, the investment potential escalates even further.

A word of caution, however. The risk factors associated with any investment cannot be overlooked. While American Tower displays strong financial and trading performance, investors should contemplate their risk-reward ratio before jumping in. Besides, the telecommunications industry is inherently volatile and highly sensitive to technological evolution and regulatory decisions. Therefore, comprehensive research and risk assessment are vital for the prospective investors to make a wise investment decision.

In conclusion, the recent SCTR report has kindled interest in American Tower for the right reasons. With strong SCTR scoring, robust dividend yield, and a technically solid bullish movement, it certainly warrants consideration for prospective investors.