Subheading: Understanding AlphaFold and Its Market Potential

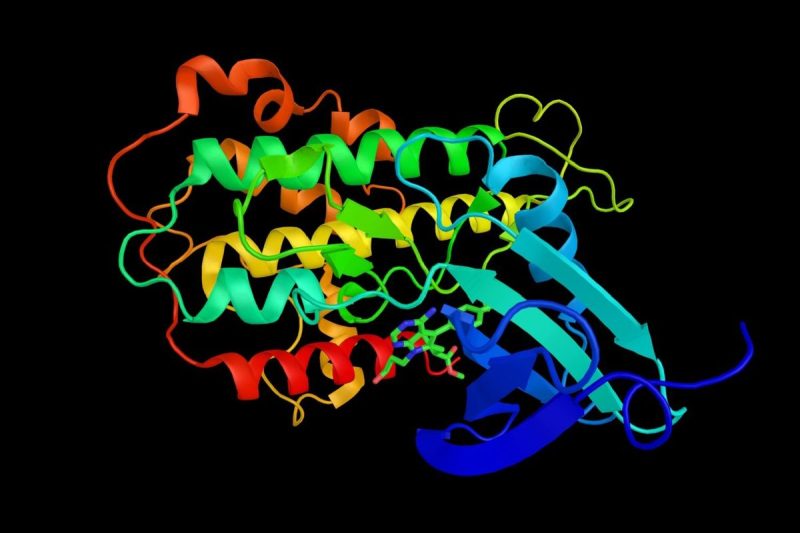

AlphaFold represents a significant leap forward in the field of artificial intelligence. Developed by Alphabet Inc’s subsidiary DeepMind, AlphaFold is an AI system that uses deep learning algorithms to predict protein structures with astonishing precision. This technology has manifold implications for science and medicine, suggesting immense potential for growth.

Nevertheless, investing in AlphaFold is not as simple as buying shares of a listed company. Since AlphaFold is a product of DeepMind, a non-public subsidiary of Alphabet Inc, one has to invest indirectly by buying stocks of Alphabet Inc (GOOGL).

Subheading: Steps to Invest in Alphabet Inc Stocks

1. Find a Reliable Broker: You will need a reputable broker to buy Alphabet Inc’s stocks. The broker should be regulated by financial authorities for transparency and security purposes. Consider costs, available investment tools, ease of use and the level of customer support when choosing a broker.

2. Open a Brokerage Account: Once you’ve found a suitable broker, you’ll need to open an investment account. This typically involves filling out an online form with your personal information.

3. Deposit Funds: After your application is accepted, you may now deposit funds into your account. The method widely varies per broker but it can be done usually via bank transfer, credit/debit card payments, or even PayPal.

4. Buy Alphabet Inc Stock: Now that you have a funded account, you can buy Alphabet Inc (GOOGL) stock. Simply search for the ticker symbol ‘GOOGL’, decide the number of shares you want to purchase, and click on ‘buy’.

Subheading: Following a Long-Term Growth Strategy

While investing in Alphabet’s stock is an indirect way of investing in AlphaFold, it is a sound strategy given Alphabet’s diversified portfolio that includes Google, YouTube, and Google Cloud besides DeepMind. Since these entities are both profitable and influential in their niches, Alphabet’s stocks generally promise a good long-term return.

Also, the potential of AlphaFold must not be underestimated. If the technology was fully commercialized, it could revolutionize drug discovery, biological research, and many other sectors, increasing the Alphabet’s market value.

Subheading: Managing Investment Risks

Though the potential gains can be enticing, investing in any form of stocks involves risks. The stock market can be volatile, and prices can fluctuate significantly in short periods, powered by various factors like economic indicators, interest rates, political developments, or corporate earnings reports.

Therefore, diversification is key. Instead of investing all your money in Alphabet simply because you want a stake in AlphaFold, it’s recommended to create a diverse portfolio to spread your investment risk.

Subheading: Ongoing Monitoring of Investment

Once you have invested in Alphabet Inc’s shares, it is crucial to monitor your investment continuously. Keep yourself updated with the latest news on Alphabet, financial market dynamics, and other data that might affect your investment in the company.

Reviewing your investment portfolio regularly will ensure you can react timely to market changes or any adverse events. This is a vital step to safeguard your investment and potentially increase your returns.

By considering these factors and following these steps, you can strategically invest in AlphaFold’s success through purchasing stock shares of Alphabet Inc. Remember, investing requires a mix of knowledge, preparedness, and diligence to ensure growth and mitigate risks.