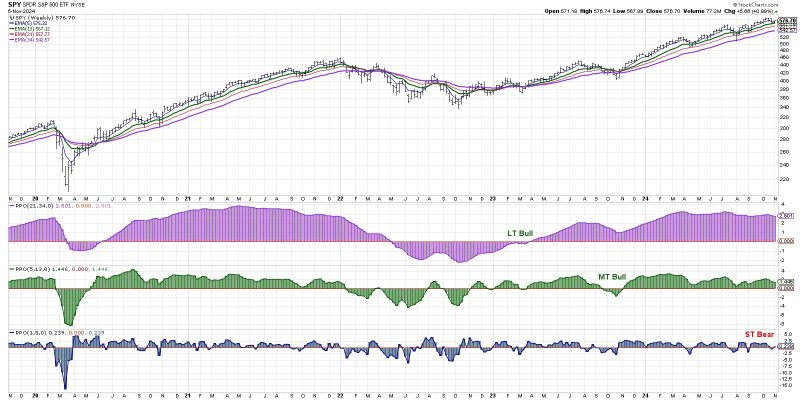

The global strategic environment is currently characterized by great uncertainty, with several historical economic, social, and political factors aligning simultaneously. In this context, this article aims to discuss the potential for a short-term bearish signal as markets brace for a news-heavy week.

Firstly, it is important to understand what a bearish signal implicates. In financial markets, a bearish signal signifies an expected decrease in prices, typically driven by underlying economic indicators and market analysis. This assertion essentially forecasts a decline or downturn in market sentiment, impacting investor’s decisions on buying, holding, or selling.

One aspect that significantly drives short-term bearish signaling is the combination of multiple financial news, economic releases, and geopolitical events, all scheduled to happen around the same time. This imminent news storm can swing market sentiment quickly and unexpectedly towards a bearish stand. With high-profile political events, policy changes, central bank decisions, and high-stake company earnings scheduled for release in the upcoming week, the markets are exposed to extreme volatility.

For instance, central banks’ policy meetings and decisions often have far-reaching impact on the financial markets. The anticipated changes in the monetary policy play a significant role in shaping market trends. During these events, any indication of a restrictive monetary policy can lead to market sell-offs, thereby triggering bearish sentiments.

Secondly, geopolitical events and uncertainties such as elections, conflicts, or trade deals significantly influence market direction. A study by Baker, Bloom, and Davis (2016) confirmed that economic policy uncertainty increases market volatility and significantly correlates with a decline in investment, output, and employment in policy-sensitive sectors.

Company earnings calls also add to the market’s volatility. Financial reports unravel the performance of companies and sectors, causing shifts in stock-specific and broad-market sentiment. Any indications of poor performance from market giants could push the entire market towards bearish territory.

Economic data releases such as employment statistics, GDP figures, and inflation rates are influential markers for the capital markets’ health. These indicators offer concrete figures, affecting market sentiments based on overall economic performance and triggering the optimism or pessimism among investors.

Therefore, when markets are bracing for a news-heavy week, there tends to be an increase in market volatility and risks which can subsequently push prices lower. It acts as a prerequisite to a bearish sentiment, conditioned by expected economic reports and anticipated market reactions.

However, while the short-term bearish signal may be worrying for some, it’s important to remember that such market corrections are a natural part of the financial cycle. They offer opportunities for investors to enter at lower prices and for markets to rejuvenate and reset after periods of unfounded enthusiasm.

The innate unpredictability of market sentiment shows why it’s important to take a balanced investment approach that includes both offensive and defensive postures. Consistently keeping an eye on market news, analyzing potential risks, and adjusting investment strategies can help investors navigate through a news-heavy week teetering towards potential bearish sentiment.

In summary, anticipating a bearish market in the short-term is not an unexpected phenomenon when bracing for a news-heavy week. The alignment of various scheduled releases and events can heavily influence market sentiment and trigger volatility, thereby leading into bearish territory. The extent to which an investor uses this inherently uncertain period wisely and proactively will significantly impact their long-term financial success.