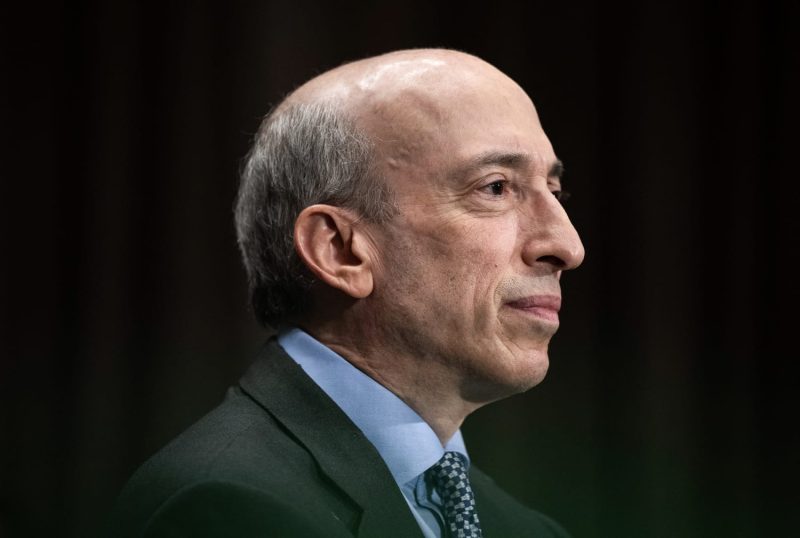

Amidst the sea of changes in the political and economic arena, there comes another transformation with SEC Chair Gary Gensler announcing he will step down on January 20. The resignation leads the path for the appointment of a replacement by the Trump administration. Gensler’s decision to step down from the Securities and Exchange Commission (SEC) will certainly influence the direction of the U.S. financial market regulatory scene.

Gensler, known for his no-nonsense approach towards regulations, has been instrumental in shaping the post-financial crisis landscape of Wall Street. His tenure has been marked by a raft of new rules aimed at tightening regulation on hedge funds, private equity firms, and other non-bank financial institutions. His watch at the SEC saw its focus shift from merely regulation to sustainability, transparency, and technological integration.

As the Trump administration will nominate a replacement, a reflection on the approach of the outgoing SEC chair is important. Gensler has insisted that Wall Street should be made to work for everyone, not just the privileged few. This mindset is reflected in the rules he implemented, intending to level the playing field for small investors and business institutions. The trajectory on which Gensler steered the SEC could see dramatic shifts with a new chair entering.

The incoming chair will be appointed by the Trump administration— a detail that could weigh heavily on the SEC’s future trajectory. The Trump administration is well known for its deregulatory approach in certain areas of the market, characterized by a belief that less restriction paves the way for innovation and growth. However, this approach marked a stark contrast with Gensler’s more regulatory-based perspective.

Assigning new leadership to the SEC also poses a series of questions about the future of regulations. How will the Trump-appointed chair handle matters related to crowdfunding, initial coin offerings, and other forms of fintech that have been gaining momentum? Moreover, how will the SEC tackle big tech companies and their increasing role in financial services? These crucial matters fall within the scope of the SEC, and the direction the new chair takes will be significant.

Maintaining the balance between unfettered market activity and consumer protection will undoubtedly remain the SEC’s utmost concern. The regulatory body’s next chairperson needs to establish a clear plan for how to bolster market growth while respecting investor safety and maintaining transparency across the board.

Gensler’s impending departure marks the end of a dynamic and transformative era for the SEC. As the Trump Administration gears to appoint a new watch guard, questions hang in the balance regarding the future of the SEC under its new leadership. As regulators around the globe grapple with new-age financial tools and technologies, the role of the SEC chair is set to become even more crucial.

Moving ahead, the next chairman will have the task of navigating the regulatory authority through a diverse range of challenges. Market volatility, challenges of technology integration, cybersecurity threats, handling financial tech startups, and dealing with economic shifts due to the COVID-19 pandemic will be significant areas to address.

Gary Gensler’s tenure as SEC Chair will be remembered for its relentless push for transparency, accountability, and fairness in the financial market place. As he steps down in January, all eyes will be on his successor and the course they chart for the crucial regulatory body. Until then, the financial market will be holding its breath in anticipation.