While diving into the vast ocean of business development and investing, there are multiple areas of knowledge requiring significant understanding. One such integral domain is ‘Market Research and Analysis,’ specifically focusing on ‘Technical Analysis.’ This study is fundamental to comprehend financial markets better, their respective technical indicators, and their speculative nature.

Technical analysis, in simple terms, is a forecasting method that investors and businesses employ to predict future market price movements. It involves a statistical review of market activity, such as price and volume changes, to identify patterns that may suggest future activity. Technical analysis not only helps in forecasting price trends but also gives a deep insight into the investor sentiment.

Marketers and investors generally follow two essential types of analysis – fundamental and technical – out of which, each functions on a different premise. While fundamental researchers concentrate on analyzing an entity’s inherent value, their technical counterparts focus on statistical market patterns and trends.

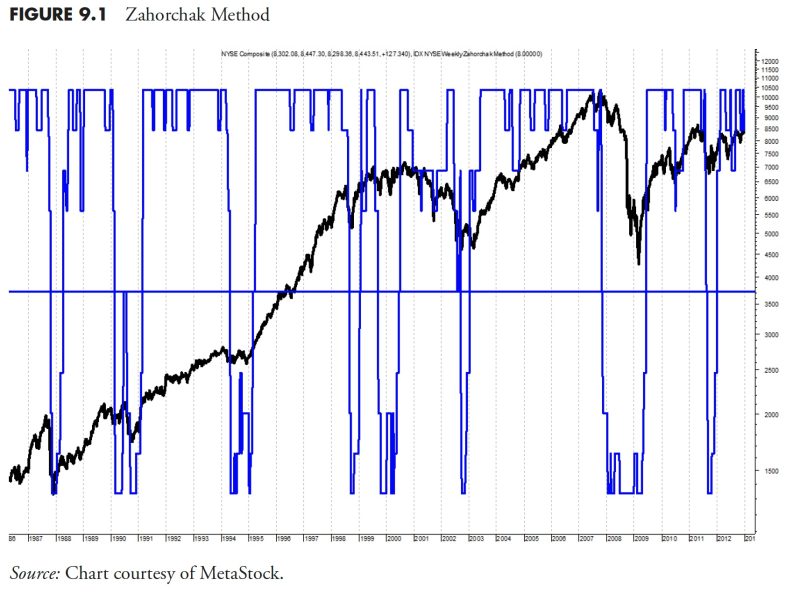

What distinguishes technical analysis is its primary reliance on charts and other graphical displays of market data, making it perhaps more visually engaging than its fundamental counterpart. These charts tend to convey large volumes of information in a digestible format that can provide a snapshot of market activity over varying periods.

An essential part of technical analysis is ‘indicator study,’ which involves the use of various statistical measures to predict future market movements. These can range from simple moving averages, which show the average price over a given period, to more complex oscillators, which compare the strength of recent upward trends to recent downward ones. This depth of analysis is crucial for investors as it aids in risk mitigation and optimizes investment decisions.

Technical analysis provides a relatively flexible and adaptable methodology than fundamental analysis as it primarily deals with price and volume data, which is easily sourced and analyzed. This adaptability imbues it with a relative independence that allows it to be applied across a broad spectrum of markets and entities.

In addition, the predictive nature of technical analysis can grant investors a competitive edge, potentially empowering them to anticipate and respond to market changes more proactively than those who rely exclusively on fundamental evaluation. This predictive power is increasingly valued in a rapidly-evolving market climate characterized by high volatility and unpredictability.

Finally, technical analysis adds value to the decision-making process by acting as a supplementary tool that consolidates the findings of fundamental analysis. In this way, the process creates a more rounded and balanced overview of the market situation. It’s not about discounting the importance of fundamental analysis, but rather, using technical analysis to maximize its effectiveness.

In conclusion, technical analysis significantly contributes to comprehensive market research and analysis. By paying close attention to market trends and patterns, investors and marketers can utilize this method to predict future price movements and make informed decisions to benefit their investments or business growth.