Body:

Understanding Gap Down Reversals:

Before delving into the process of identifying and profiting from bullish gap-down reversals, it is imperative to understand what this trading strategy entails. Factually, a gap-down reversal occurs when a stock opens at a lower price than its previous day’s close but climbs throughout the day to close higher than it started. This scenario, often characterized by a bullish gap-down reversal, can provide lucrative opportunities for the astute trader. The event is a significant indicator that the market sentiment towards the security is shifting from bearish to bullish.

Identifying Opportunities for Bullish Gap-Down Reversals:

To profit from bullish gap-down reversals, it is paramount to detect the right opportunities. The anatomy of the reversal includes a gap down, followed by a buying pressure that forces the stock price upwards, leading to the close being higher than the opening. The ideal situation would be when the volume of the selling pressure that leads to the gap down is high – indicating panic selling, succeeded by heavy buying volume. These characteristics signal that the stock may be oversold and due for a price correction.

Prudent traders often characterize the ideal bullish gap-down reversal with the following traits:

1. The stock is in a long-term upward trend.

2. The initial gap down is significant – usually more than 5% below the previous day’s close.

3. There is a notable increase in trading volume, indicating panic selling.

4. Before the market close, the stock price surges back up, overcoming the initial gap-down.

Investing at the Right Time:

Sophisticated investors and traders know that timing is ever so crucial when dealing with gap-down reversals. An ideal entry point would be just after the market open, assuming there is evidence of buying pressure. Regardless of this rule of thumb, it is equally vital to maintain vigilence through careful observation of market patterns and trading volumes.

One of the critical indications for an optimal entry point is the appearance of a bullish candlestick pattern following the gap down. Recognizable patterns include hammers and engulfing candles, which are both strong indicators of a potential upwards trend.

Setting Stop-loss Orders:

Given the inherent risk associated with any trading strategy, setting up a well-thought-out stop-loss order is essential for managing downside risks when playing with bullish gap-down reversals. The order can protect the investment by triggering a sale if the stock’s price falls past a certain point.

In the context of bullish gap-down reversals, a good practice is to set the stop-loss order slightly below the lowest point of the gap-down day. Traders often adjust this based on the stock’s volatility and their personal risk tolerance.

Maintaining Patience and Discipline:

Traders looking to profit from bearish gap-down reversals should embody unwavering patience and strict discipline, as the strategy often requires waiting for the patterns to confirm. It is equally important to resist jumping into a position too early or chasing the stock if missed the ideal entry point.

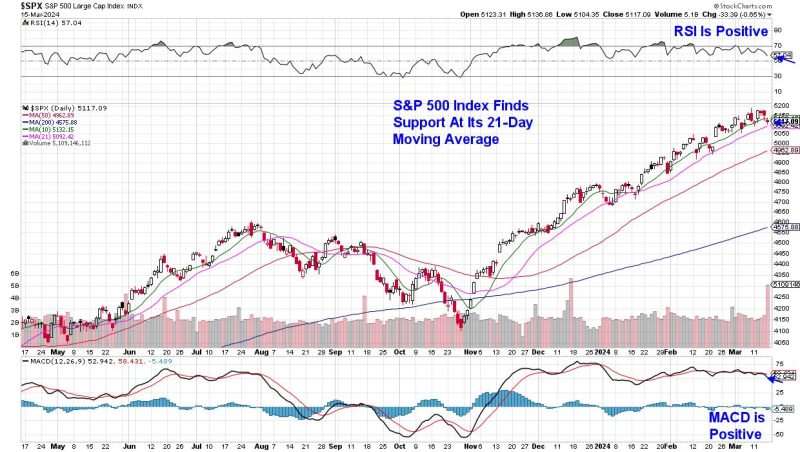

Profiting from bullish gap-down reversals demand a rounded understanding of the stock’s reported fundamentals and behavior patterns. It is also beneficial to utilize technical tools like Bollinger Bands, Moving Average Convergence Divergence (MACD), and Relative Strength Index (RSI) to support decision-making. An amalgamation of these aspects can increase the probability of capturing profitable opportunities during a bullish gap-down reversal.

In conclusion, bullish gap-down reversals can serve as potent trading strategies for those with an appetite for higher risk and reward scenarios. By recognizing the right set-ups, timing trades accurately, and managing risk efficiently, traders can enhance their portfolio’s profitability while minimizing potential losses.