The dynamic economic landscape guarantees us a treasure trove of continual transformations. One significant evolution currently making waves in the financial market is the expansion of the bull market. This expansion is not just a seasonal fluctuation but groundbreaking news that has channeled a wave of positivity and optimism among investors who are enthusiastically pursuing the lucrative opportunity that this phenomenon presents.

Conceptually, to understand the significance of this bull market expansion, one must first comprehend what a bull market is. In simple terms, a bull market is a phase in the financial market where securities prices are rising or expected to rise. Named after the manner in which a bull attacks, it typically illustrates a market where investor confidence and economic growth are on the upswing. The ongoing expansive phase dials up the bullish trend, making this an ideal time for investors to enjoy substantial returns on their investments.

This recent bull market expansion is being fueled by a variety of factors. Foremost among them is the recovering and thriving economy following the havoc wreaked by the Covid-19 pandemic. This resurgence is leading to increased business activity, implying better productivity, sales, revenues, and, subsequently, higher stock prices. This bull market is also buoyant due to the expansive monetary policy implemented to counter the economic disturbances caused by the pandemic.

Another driving force bolstering this expansion is the technology sector. With consumers becoming increasingly reliant on digital platforms for work, entertainment, and retail, tech stocks witness a substantial growth. This trend is invigorating the bull market, making it more robust and expansive. Additionally, the robust housing market, driven by low mortgage rates and increased demand for suburban homes, also significantly contributes to the thriving bull market.

While the expansion of the bull market offers a promising landscape for investors, it’s crucial to exercise wisdom and caution. Investors need to strategically expand their portfolio, factoring in both the short and long-term trajectories of the market. One simple strategy is to diversify investments to mitigate risk. Even in a thriving bull market, it’s wise to spread your investments across several sectors.

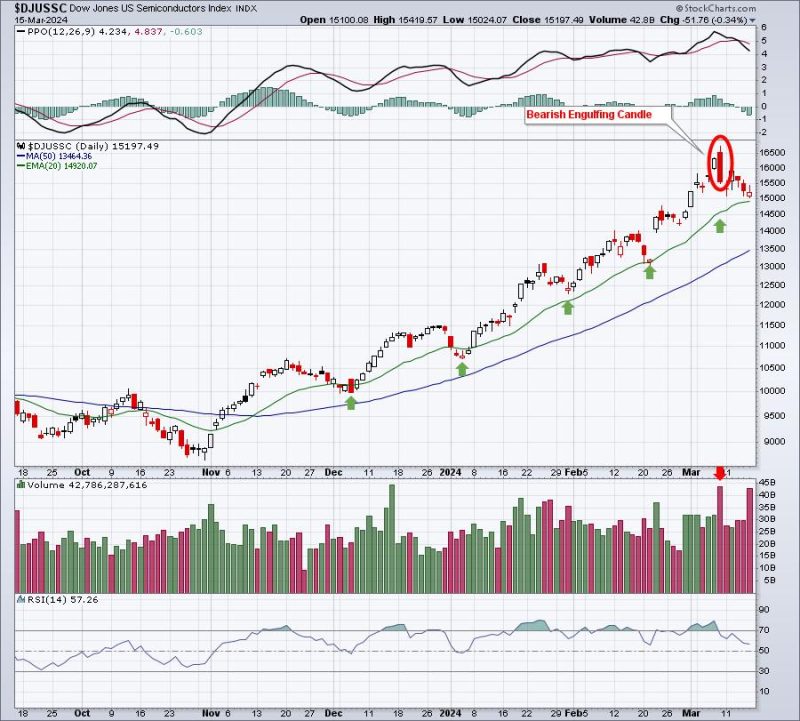

Investors should also keep an eye on prominent market indicators because, as history has shown, markets always correct themselves. Therefore, while riding the bull market wave, investors should also prepare for potential corrections. In-depth research, diligent market monitoring, and expert advice can guide decisions in such times.

Another factor to consider is how other financial markets react to this bull market expansion. Foreign markets and commodities, such as gold and oil, can be influenced by these shifts as well, and so, their constant monitoring can help identify profitable investment opportunities.

Indeed, the current expansion of the bull market signals a promising time for investors. Fueled by a series of factors, from a recovering economy to booming sectors like technology and housing, this bull market presents a lucrative opportunity for investors. However, strategic planning, careful investment spread, and meticulous monitoring of market indicators are critical to capitalizing on this opportunity wisely and effectively. It’s a great news for all investors – let’s ride this bullish wave for significant returns.