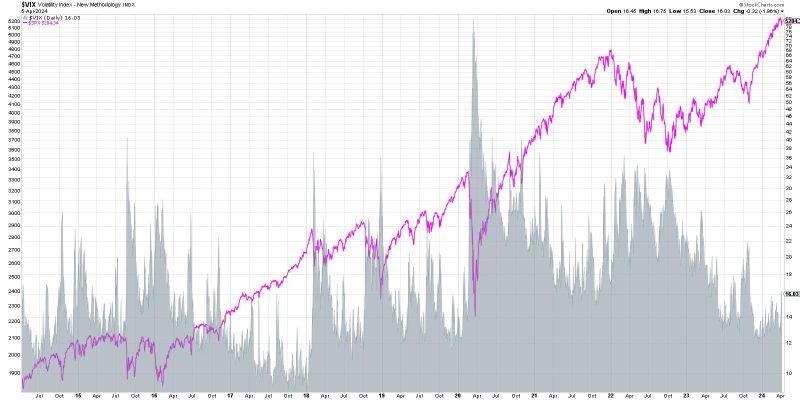

The Volatility Index or VIX, a key measure of market expectations of a near-term volatility conveyed by S&P 500 index option prices, spiked above 16 recently, leaving investors and traders questioning: ‘Is this the end?’ A jump in the VIX usually signals increased volatility in the market and often correlates with falling asset prices. Therefore, the primary question on everyone’s mind is whether or not this marks the beginning of a period of negative performance for the equity market.

Understanding the VIX

Commonly known as the ‘fear index’ or ‘fear gauge,’ the VIX quantifies market volatility by measuring the market’s expectation for future volatility. When the VIX spikes, it usually means that traders anticipate more variation in the price of stocks in the S&P 500 index, and such periods of volatility typically coincide with market downturns. Thus, VIX spikes are often seen as predictors of market crashes.

However, it is essential to understand that the VIX doesn’t measure the direction of price changes, only their expected magnitude. Therefore, a high VIX could also indicate substantial positive price swings.

The Reasons Behind the Spike

In the recent VIX climb above 16, several factors could have contributed to the jump. The ongoing geopolitical tensions, concerns of the Federal Reserve’s potential policy improvements, high inflation fears, and discussions over the globe’s economic recovery slowdown have all resulted in increased volatility.

In addition to financial indicators and events, the VIX also responds to shifts in market sentiment. Trepidations about global instability, changing governmental policies, or economic indicators can cause shares to swing wildly. This change in sentiment can significantly impact expected premiums for options contracts, leading to movements in the VIX.

Implications for the Market and Investors

With the VIX climbing and fear mounting, it’s natural for investors to get uneasy. Although volatility and uncertainty can lead to severe financial losses, it is essential to remember that these periods could provide opportunities for profit-generation as well. A high VIX could imply that options premiums are high, creating an opportunity for traders who sell options.

Investors who take a long-term view of the equity markets might perceive these periods of heightened volatility as buying opportunities. In periods of market downturns, when others are fearful, savvy investors could capitalise by buying under-priced assets.

Therefore, despite the scary implications of a spiking VIX, it is crucial not to panic. Instead, this could be a signal to re-evaluate your portfolio and adjust your investment strategy to protect or even profit from the increased market volatility.

An increase in the VIX doesn’t always signify that the end is near for the equity market. Often, it could merely indicate that investors are moving away from risky assets and looking for safer havens. However, it does symbolize an enduring trend of unpredictability, and investors should be prepared to navigate these tricky market conditions.

Thus, a spike in the VIX is an admonition for investors to stay vigilant, rather than a predictor of doom. It is a call to carefully monitor the financial landscape, align strategies with risk tolerance and investment goals, and seize potential opportunities when they appear.