Assessing the Downside Risk

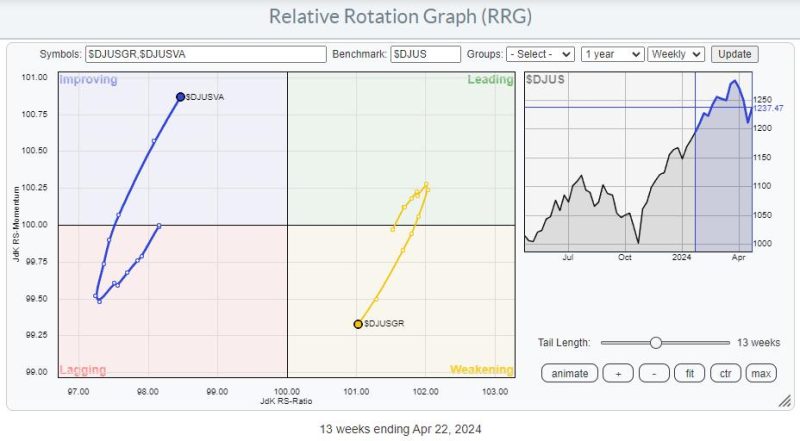

Understanding the downside risk for stocks is crucial in formulating a sound investment strategy, especially in a shifting market stage susceptible to various unexpected changes. Currently, equity markets are undergoing a structural shift where investors are seemingly favoring value stocks, inevitably triggering a speculated 10% downside risk for other stock sectors.

Value Takes The Lead

The focus on value stocks arises from the strong performance of companies with tangible assets and reliable income streams. Value stocks typically represent sectors such as financial services, energy, and industrial companies. As investors continue to pivot towards value sectors, those sectors previously dubbed as high-growth – such as tech sectors – face amplified risk of depreciation. This shift in investments creates a predicament for growth-focused portfolios, leading to an anticipated 10% downside risk.

Implications of Shifting Trends

The performance of stocks has a substantial impact on the investment environment’s broader atmosphere. Stock performance is a critical indicator of the financial health of companies and, by extension, the overall economy. As investors shift their focus to value stocks, this trend sends strong signals about the projected performance of other sectors. The anticipated 10% downside risk signifies gloomy expectations for non-value stocks, which may trickle down to impact investor confidence adversely.

Assessment of 10% Downside Risk

While the sweeping shift towards value stocks suggests a downside outlook for other asset categories, it’s imperative to delve into the factors corroborating this predicted 10% downside risk. The ongoing economic recovery following the pandemic-related instability has made investors more cautious, tilting their interest towards less volatile value stocks. Simultaneously, heightened valuation levels and concerns about future inflation can further intensify the 10% downside risk, making the equity market more susceptible to fluctuations.

Mitigation Strategies

There are several strategies investors can employ to mitigate the 10% downside risk. Diversifying portfolios across various sectors is one such strategy that can increase risk tolerance. Similarly, hedging against potential losses using derivatives is another proven risk management tool. Investors may also consider shifting their holdings to sectors or companies projected to grow despite the perceived risk.

Anticipated Market Dynamics

The 10% downside risk, compounded with the shift towards value stocks, signals new and evolving market dynamics. Market trends suggest that investors will continue showing an interest in value stocks in the foreseeable future, given their propensity for reduced volatility and stable returns. As a result, growth sectors may take a backseat until value stocks fail to offer the attractive dividends currently being perceived.

In essence, the 10% downside risk for stocks doesn’t spell doom for the market but indicates a shift towards value stocks. This change underscores the importance of adaptive risk management strategies amid changing market dynamics. For investors weathering the turbulence, the present scenario is a reminder of the timeless wisdom of not putting all eggs in one basket.