The ensuing excitement around NVDA earnings is palpable among market observers, analysts, and investors alike. NVDA, officially known as Nvidia Corporation, stands as a pioneering leader in the digital age, predominantly carving its niche within the graphics processing units (GPU) sphere. As its earnings release date draws near, markets are teetering on the edge of their metaphorical seats, bracing for impact, positive or otherwise.

Nvidia Corporation has carved a solid footprint in the tech industry with its innovative GPU products. The California-based tech giant has driven significant strides in computer graphics, artificial intelligence, and other high-tech domains. With the increasing embracement of heavy-tech solutions and digital transformation, NVDA has a high market demand and anticipations around NVDA earnings are valid.

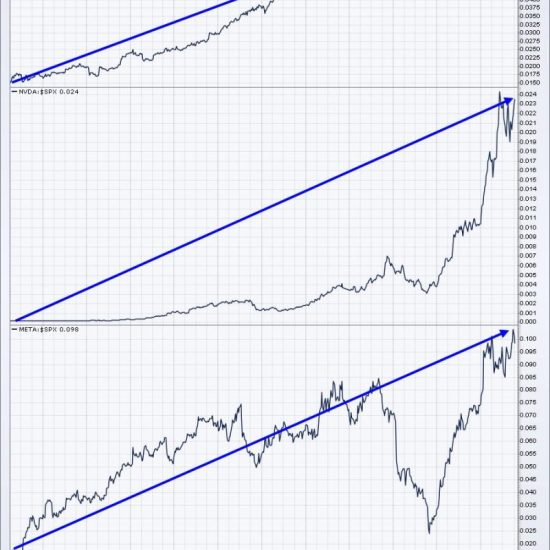

NVDA’s financial dynamics are intriguing and multifaceted. Its year-over-year revenue and earning growth have outpaced the broader market, reflecting sustained excellent financial health. Bullish investors have pinned their hopes on NVDA as the tech company offers stellar financial performance and excellent operator execution. They attribute potential upswings to Nvidia’s business model, which relies on offering products and services that make it indispensable in a progressively digital world.

Nvidia’s primary revenue stream emanates from its GPU business. Powerful GPUs are central to an array of applications in gaming, data centers, cloud computing, and even cryptocurrency mining. Nvidia, thus, remains well-placed to capitalize on these trends, further intensifying curiosity and expectations towards its earnings announcement.

However, markets are also keenly aware of the risks embedded in the NVDA earnings report. This includes the global chip shortage which has created turbulence in the tech world. Production constraints and increased costs could potentially hamper the company’s profitability. Moreover, the unpredictable nature of cryptocurrency markets and their impact on Nvidia’s GPU supply-demand dynamics also remains a concern.

The company is also subjected to geopolitical influences. NVDA’s acquisition of ARM Holdings is marred with regulatory hurdles, with China’s regulatory authorities keenly watching the unfolding saga. Furthermore, competitive pressure from rival tech giants like Intel and Advanced Micro Devices (AMD) can also influence NVDA’s financial outturn.

Analysts opine that NVDA’s earnings expectations need to realistically incorporate these risks. They advise a holistic reading of the NVDA financial results, where potential pitfalls are screened along with the flashy empirical highlights.

While Nvidia has consistently demonstrated strong earnings performance in the past, investors are reminded of the classical investment principle that past performance is not necessarily indicative of future trends. Nonetheless, the market is closely eyeing NVDA’s earnings growth rate, which, if sustained or surpassed, could further launch the tech behemoth onto higher levels of market valuation and investor delight.

As the anticipation grows in the financial world, only the actual announcement of the NVDA earnings will truly satiate the market’s curiosity. Markets, investors, and analysts want to verify whether NVDA maintains its compelling financial story or new chapters of concerns get added to its fiscal narrative. Whatever the actual figure, for now, the markets are bracing themselves for NVDA earnings, demonstrating the significant dynamic effect this tech player possesses on broader tech-anchored market spheres.