RRG Identifies A Positive Trend in non-Mega Cap Technology Stocks

The RRG, or Relative Rotation Graph, has recently indicated a positive trend in non-mega cap technology stocks, suggesting that this segment of the market is becoming increasingly attractive to investors.

In contrast to mega-cap tech stocks such as Apple, Microsoft and Amazon, whose market cap is often in the trillions of dollars, non-mega cap tech companies have smaller market capitalizations. These companies, while smaller, often provide investors with greater opportunities for growth, complementing a diversified investment portfolio.

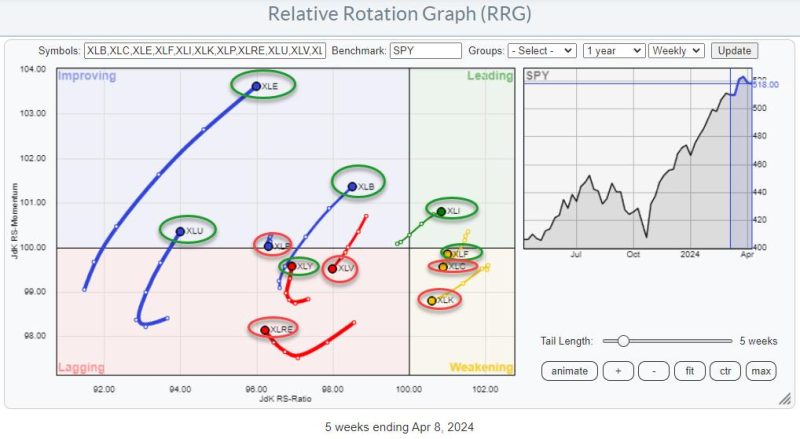

The RRG is a unique tool used by financial analysts and investors to visualize the relative strength and momentum of multiple stocks within a specific sector. It can potentially show the outperformance or underperformance of specific stocks and sectors. By observing the recent rotation on the RRG, it has been found that non-mega cap tech stocks are heading towards the leading quadrant.

It’s worth noting what the RRG’s different quadrants indicate. The leading quadrant implies that stocks within it are outperforming the benchmark with increasing momentum. The lagging quadrant is the opposite, indicating underperformance. The improving quadrant contains stocks that are still underperforming but with increasing momentum. Lastly, the weakening quadrant includes those that are leading but losing momentum.

Currently, non-mega cap stocks are rotating into the leading quadrant from the improving quadrant, indicating growing momentum. This administration is encouraging, as it suggests that these smaller tech companies are gaining relative strength against their larger counterparts, creating potentially lucrative opportunities for investors.

There are several reasons behind this shift. Non-mega cap tech stocks are often more agile and innovative, generating high growth rates. In the current business environment, characterized by rapid technological innovations, these companies have the potential to adapt and capitalize quicker than their larger counterparts. In addition, the astronomical valuations of the FAAMG stocks (Facebook, Amazon, Apple, Microsoft, and Google) are causing some investors to look elsewhere for the potential of better returns.

Moreover, as investors increasingly advocate for ESG considerations, smaller companies often have an advantage in effecting meaningful change due to more manageable scales. As a result, such companies are attracting investors’ attention due to their potential in providing both financial returns and social impact.

It’s also worth considering that diversity is a key aspect of a strong investment portfolio. With mega tech stocks currently dominating the market, there is a growing need for investments in diverse sectors. Non-mega cap tech stocks provide a good opportunity to diversify portfolios and spread risk.

However, despite the outlined potential benefits and appeals, investing in non-mega cap stocks is not without its risks. These stocks are notorious for their volatility, and potential investors should proceed with caution. Detailed analyses and diversified investment strategies should be adopted when approaching this investment opportunity.

In conclusion, while caution has to be taken due to their inherent volatility, non-mega cap technology stocks are taking a positive turn as indicated by RRG’s latest rotation. As these companies provide significant growth potential and help diversify portfolios, they may result in an appealing investment strategy for those willing to navigate the associated risks.