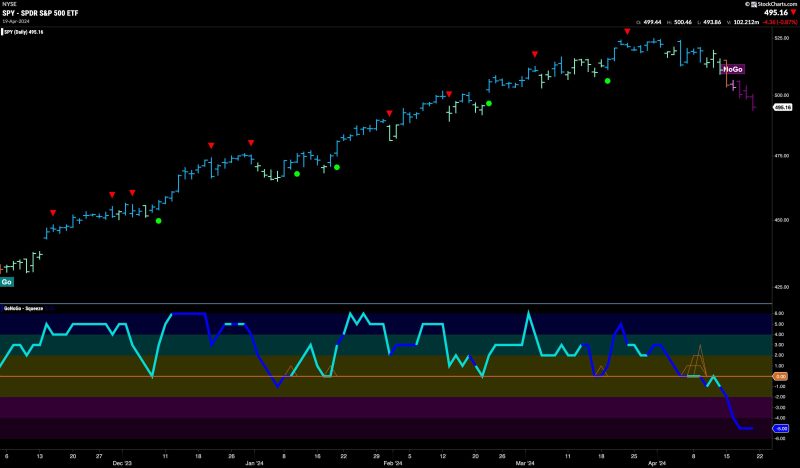

The global markets are navigating a unique landscape as equities continue to grapple with a strong NoGo phase amid volatile trading conditions. NoGo refers to a phase when equities do not have a clear direction up or down; essentially a period of standstill or slight depreciation. This driftless phase in the equities market, coupled with global economic uncertainties, such as political upheavals and health crises, have amplified investor concern. However, materials, a historically defensive sector, are gaining traction, seemingly trying to buffer the damage.

The equity market, a critical indicator of economic health that usually surges with investor optimism and economic resilience, is now locked in a tightening grip of unpredictability. The main culprits driving the NoGo phase are economic uncertainties triggered by diverse factors ranging from geopolitical unrest, inflation fears, monetary policy changes, to recent health crises. This environment has fed market volatility, resulting in an almost frozen, uncertain phase for stocks and shares.

As a typical reaction to such distress, sectors that are perceived as less vulnerable to economic fluctuations usually take the driving seat, attempting to edge out some form of stability. Among these sectors, materials are currently becoming the beacon of hope as they strive to curb the damage. These include industries such as chemicals, construction materials, containers and packaging, metals and mining, and paper and forest products. If history is anything to go by, these ‘safe havens’ have shown resilience in periods of market turbulence providing some form of buffer for investors.

The rise in commodity prices, partly due to supply chain disruptions and increased production costs, has favored material-based stocks. For example, the unprecedented rise in prices of gold, silver and other precious metals over recent times have made mining industries benefit handsomely. Further, the ongoing global infrastructure boom, powered by reforms, especially in developing economies, is also bolstering the demand for construction materials; hence, providing a fillip to related stocks.

Meanwhile, in the chemicals industry, despite facing its own set of challenges like logistics issues and raw material pricing, companies having exposure to specialty chemicals, given their wide industrial use and less substitution risk, seem to have managed to hold their ground in the face of adversity.

Moreover, to hedge against inflation, investors have been seen gravitating towards equity sectors with tangible assets such as materials. This transition reflects the strategic flexibility inherent in financial markets, wherein industry sectors shuffle roles between playing offense and defense in sync with market conditions.

The paper and forest products industry is another area that’s showing resilience. The increased demand for packaging, primarily driven by the e-commerce boom during pandemic-induced lockdowns, has incited a positive sentiment for this sub-sector.

The current NoGo state in the equities markets indicates a cautious market sentiment where investors are likely holding back due to the uncertainty. However, the rise of these materials industries offers a glimmer of hope as they try to curb the downslide. For now, investors are keeping themselves glued to fundamentals, monitoring changes in the global trade landscape, and cautiously anticipating a breakthrough from the standstill. This episode once again underlines the inherent dynamism of the world of finance, and why investors must tune their strategies to the market’s ever-shifting rhythm.