The Silver Cross (also believed to be the ‘Golden Cross’ in Wall Street) phenomenon is a well-known technical analysis tool used in the stock market trading world, and has become a highly regarded forecast indicator for medium- and long-term investment purposes. With specific relevance to the Dow Jones Industrial Average (DIA) and the Russell 2000 Index (IWM), potential Silver Cross buy signals are consistently under watchful eyes of traders worldwide, specifically as these two indexes present an encompassing overview of the U.S. economy.

Firstly, it’s fundamental to understand what a silver cross stands for. It is demarcated by the intersection of the 50-day Moving Average (MA) surpassing the 200-day MA. When the 50-day MA crosses over the 200-day MA, it creates a breakout pattern known as a ‘Silver Cross’. This pattern typically manifests a strong positive momentum for a stock or index, and signifies a positive buy signal for market participants.

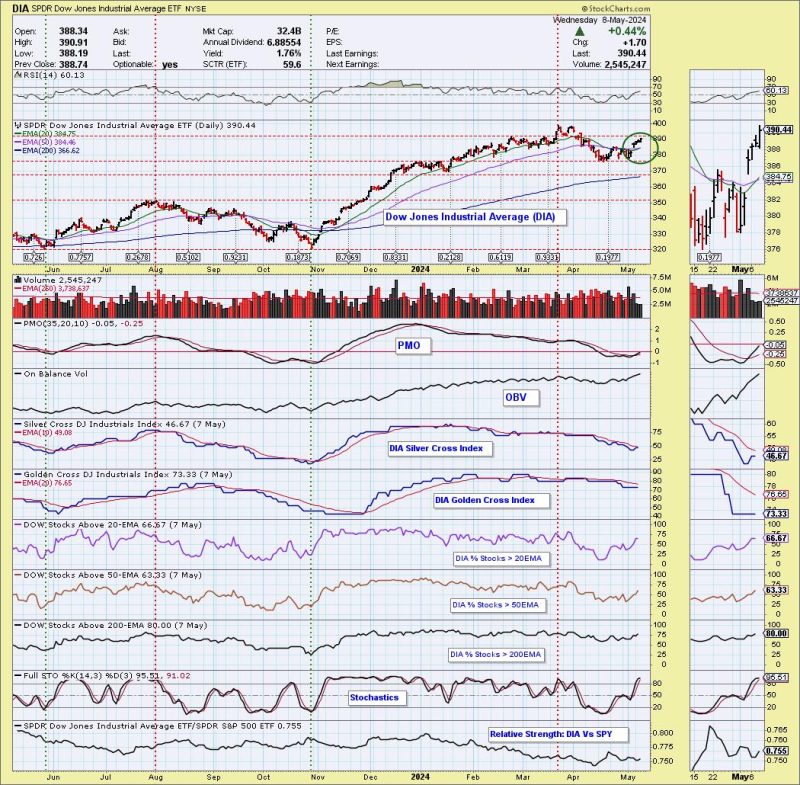

Taking a look at the Dow Jones Industrial Average (DIA) as the first example, monitoring a Silver Cross buy signal is particularly noteworthy. Geared towards reflecting the health and changes of the American industries, the DIA represents 30 large-cap American companies. A silver cross on this index may generate a strong buy signal, indicative of a bullish market trend. Fluctuations and patterns shown by the DIA often represent wider stock market trends, and a Silver Cross buy signal here can symbolize a persistent positive market trend.

Moreover, when broad market indices like the DIA show a silver cross, it could potentially present upbeat projections for individual stocks too, which allow traders to expand their portfolio by buying the dip. However, wise investors always consider other market-related parameters along with silver cross signals for more precise predictions and to offset potential risks.

Similar indications can be observed on the Russell 2000 Index (IWM). Comprising small-cap equity components, the IWM provides insights into the smaller, growth-oriented, more domestic portion of the U.S. economy. The visibility of a Silver Cross buy signal on the IWM may show a forthcoming uptrend in the small-cap realm, suggesting bullish undertones in this more volatile and risk-associated market segment.

Creating immense value for investors, a Silver Cross on a smaller index like the IWM could attribute this signal with a higher perceived risk and following reward. A Silver Cross signal can thereby allow investors to enlist into a segment of the market that holds the prospect for potentially higher returns. They may hence seize the advantageous movement and bring lucrative investments to their portfolio.

Overall, it is evident that Silver Cross buy signals have substantial relevance for investing in the DIA and IWM. However, it’s noteworthy to keep in mind that while these signals may suggest a positive market trend, they do not guarantee positive returns. Therefore, an investor must consider these signals as part of a broader, well-diversified investment strategy.

Consideration of Silver Cross buy signals on the Dow (DIA) and Russell 2000 (IWM) can be a strong part of a balanced investment strategy. As with any investment approach, it should be considered alongside other economic factors, trends, risk tolerances, and be constituted within a diverse investment portfolio for optimal benefits.