As we delve into the nuanced subject of the stock market, it is essential to expand on the frequently used term ‘market looking toppy.’ This phrase is often thrown around by market analysts and traders when referring to a particular stage in the trading ecosystem where the outlook seems increasingly bearish. However, to fully grasp this concept, one should not only understand market dynamics but also the indicators that point to a ‘toppy’ market.

A market is said to be looking ‘toppy’ when it appears to be close to the end of its upward trend. In such scenarios, prices have mostly peaked, and a myriad of patterns and indicators suggest a probable trend reversal. This alludes to the potential transition from a bull to a bear market. Indeed, markets aren’t straightforward. They are influenced by a myriad of complex factors such as politics, economics, and investor sentiment, which can blur the boundaries and make it challenging to discern when a market is ‘toppy’ or near its peak.

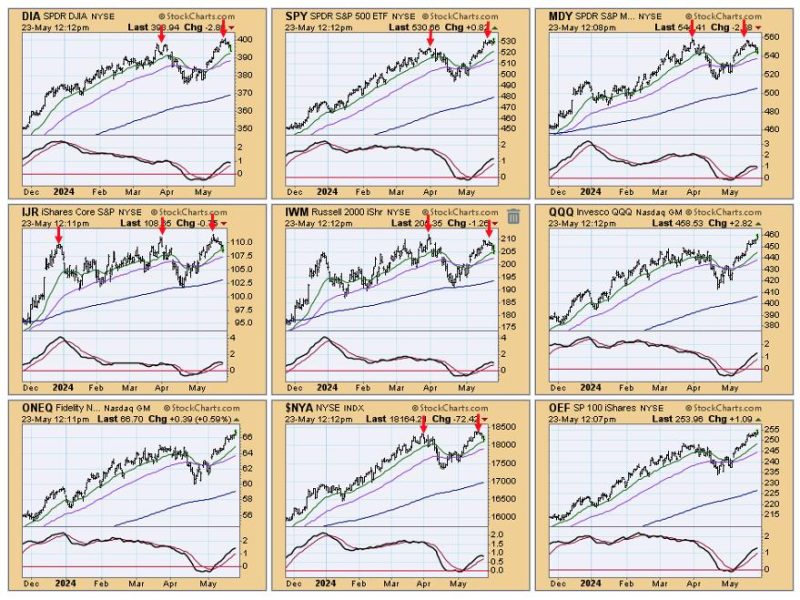

Indicators of a ‘toppy’ market are both technical and fundamental. Technical signals may include a stock or an index reaching new highs on decreasing volume; this is often seen as a red flag because healthy upswings in a bull market are typically supported by increasing volume. Additional indicators might involve divergences in Relative Strength Index or Moving Average Convergence Divergence, which usually denote weakening momentum.

In fundamental terms, a steep rise in stock valuations without corresponding earnings growth might also suggest a ‘toppy’ market. Similarly, when investors display increasing amounts of optimism or euphoria, this can often signal that the market might be in the bubble phase. Skyrocketing prices with speculative frenzy, particularly in an unprofitable sector or company, suggests that caution should be restored.

Judging a market as ‘toppy’ can create a powerful urge to jump ship before a perceived downturn. While it’s vital to be proactive and to protect assets, hastily reacting might risk missing out on potential rewards should the market continue its upward trajectory. It’s crucial for investors to stay vigilant, keeping track of market indicators and understanding that markets can remain irrational longer than one can stay solvent.

Strategies of dealing with ‘toppy’ markets can vary greatly among investors. Conservative investors might prefer to shift their assets into cash or cash equivalents once they perceive the market to be ‘toppy.’ On the other hand, seasoned traders might opt for short-selling stocks, which involves borrowing shares to sell with the hope of buying them back later at a lower price. More risk-tolerant investors might protect their portfolios by using hedging strategies such as buying put options.

In conclusion, navigating a ‘toppy’ market demands patience, vigilance, and an in-depth understanding of both technical and fundamental market signals. Investors ought to be cautious but must bear in mind that the market could still proceed upward for an unpredictable length of time. As with most aspects of investing, there’s no one-size-fits-all strategy when tackling a ‘toppy’ market. Each move should be carefully considered, factoring in the individual’s financial goals, risk tolerance, and investment horizon. Realign your approach as the market ebbs and flows, recognizing that market cycles are an inherent part of the investment journey.