BODY:

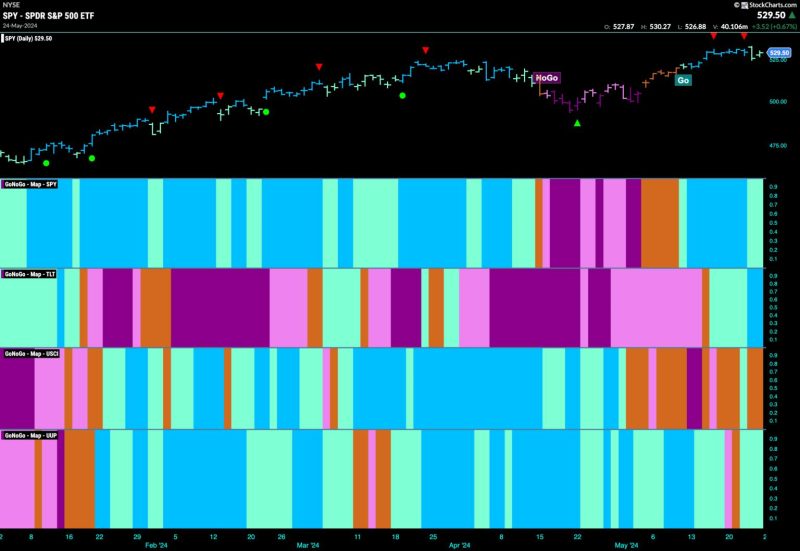

Just as in a marathon race, individual runners move at different paces through varying terrains, so too is the case with the sectors in stock markets. Some sectors surge ahead leading the rally while others lag behind trying to keep up. While equities remain on a Go trend, tech and utility sectors are showing sparse leadership.

In the initial stages of the Covid-19 pandemic when businesses were shutting down and markets plummeting, tech companies defied all odds. They became the engine of the equity market, propelling it forward even as others struggled. From enabling remote work to providing entertainment during lockdowns, these companies became indispensable. As a result, products from market leaders such as Amazon, Microsoft, and Apple became more popular than ever, leading to significant growth in share prices and market values. This compelled investors to go long on tech equities resulting in an extraordinary bull run.

Recently, the trend has seen a bit of a deceleration. This shift, or sparse leadership that we are seeing from major tech companies, can be charted as other sectors gain momentum. While tech companies continue to post strong earnings, their stock price appreciation seems to have taken a breather, reflecting a rerating of growth expectations.

On the other end of the spectrum, utility companies continue to remain underweight. As traditional defensive sectors, utilities are typically characterized by a low beta, signifying less volatility and usually outperform in a bear market. Nevertheless, they tend to underperform when equities are on a go trend, which is likely the contributing factor towards their limited leadership.

The absence of pronounced leadership from tech and utilities in the current market rally has led the way for sectors such as financials, materials, and consumer discretionary to take the front seat. The transition to a post-pandemic world has accelerated demand in these areas. High-end consumer spending is looking up as restrictions are eased, businesses are starting to invest in capital expenditures again, and the possibility of higher interest rates has improved the prospects for banks.

Incidentally, the shift in leadership positions also signifies the changing dynamics of the cyclical markets. The diversity across sectors reflects healthy market rotation, allowing underperforming sectors to catch up, and giving overheated sectors a chance to cool off. This rotation is also a reminder for investors to maintain balanced portfolios, to benefit from the upswings and protect against any sudden downturns.

Institutional investors also appear to acknowledge this shift. A noticeable number of large investment banks and multinational corporations have broadened their equity portfolio beyond technology, choosing to go long on other sectors that show promise.

While the leadership from tech and utilities may have waned a bit, it doesn’t mean the curtains have come down for these sectors. Both are paving their path towards renovation and revival: tech companies with new advancements and entry into different arenas; utilities with an upgrade to clean and renewable sources, optimizing operational efficiency.

In conclusion, despite the perceived deceleration, tech and utility sectors still play a vital role in maintaining the Go trend in equities. While their leadership may appear sparse compared to their recent golden years, their value in the market shouldn’t be underestimated. As sectors ebb and flow at different paces, it’s up to the discerning investor to sift and weigh the equities’ offerings strategically. As the adage goes, it’s not always about speed, but more about maintaining a steady and sustainable pace.